by JULIE B. MAGLIO

Hernando Sun

JAN. 22, 2019- It’s never too early for a budget session when there is an $11 million shortfall- the largest shortfall in 25 years. Budget Director George Zoettlein presented updated shortfall numbers- which amount to a little over $11 million for fiscal year 2019. Money is expected to run out in September if no action is taken. Zoettlein presented in detail several options both on the expenditure and revenue side in order to counteract the shortfall. The board favored looking into a setting up a special funding district with the Sheriff’s Office and removing the Sheriff’s Office reserves from the general fund- a sizeable amount of $9.2 million. The Sheriff’s Office would have to maintain their reserves in their own fund. Commissioner Champion urged for the board to address the shortfall over a 3 year time period, with a small percentage cut over all departments during those three years.

Prior to the budget director’s presentation, some issues with budgetary implications were addressed.

First the Sheriff’s Office requested a budget amendment to fund an additional full-time bailiff in Sheriff’s Office Budget. The additional bailiff is needed because Judge Don Barbee Jr, 5th Judicial Circuit is now assigned as a full time judge in Hernando County. The part time bailiff will remain due to special magistrate hearings and visiting judges.

The funding requested, $57,660, was approved 5-0 for the full time bailiff- taken out of the General Fund Reserves.

Property Appraiser John Emerson brought some troubling news to commissioners in regards to the relatively new power plant located at the CEMEX mine in Brooksville. It is a wood-fired biomass power plant that was converted from a coal-fired power plant. The conversion was completed and brought online in 2015, but now is not operational. In the beginning of January, there was a change of ownership on the power plant- which was owned by Florida Power Development LLC (not to be confused with Florida Power and Light) and is now owned by a branch of CEMEX. He stated that the Property’s Appraiser Office has been in litigation with the former owners of the plant as they sued Emerson for the 2016, 2017 and 2018 tax rolls.

“We have no idea what they are going to return for their tangible return for 2019. They have shut it down. It’s not producing electricity right now. It’s off the grid so even if they did- they wouldn’t be selling it to Duke or someone like that.”

He admitted he doesn’t know what that means in value.

“In 2016 we had it assessed at $160 million… There is the possibility that in 2019, the assessment won’t be $160 million.”

For the 2016, 2017 and 2018 tax assessments, Emerson says they’ve paid at about a 50% level for each year.

Allocco asked Emerson to clarify what the litigation is about.

Emerson explained, “We don’t have what they actually think it’s worth.” He said that they are having some appraisals done.

Attorney Garth Coller explained that the new owners will be the beneficiary of the litigation.

In likelihood, Emerson says that 2019 will also be part of the litigation and that the dispute may last several years.

“I’m not going to give into any of this stuff… If anybody’s going to do it- it will be a judge.”

In an amended complaint filed by the plaintiff in October, the plaintiff claims that the appraised value determined by the property appraiser of $161,347,667 in 2017 exceeds just value. The owner paid property taxes in the amount of $1,155,676.51 for 2017 while the combined taxes and assessments for that year was $2,456,533.23. The plaintiff asks for a judgement establishing the just value by the court.

Champion asked what the potential loss in revenue is. Emerson said he really can’t tell because they might send him back a $1 million tangible return for 2019- although he says just the salvage value is greater than that.

Emerson also cautioned that they just got word from Tallahassee that all homesteaded properties can not go up in value more than 1.9%. (Not including new construction.) This limitation is based on the Save Our Homes cap and the consumer price index. The 1.9% is applied to the entire state of Florida. Non-homesteaded properties cannot go up more than 10%.

Using the 1.9% on the 50,000 homesteaded properties in the county and an increase of 6% for the remaining properties, he says with this scenario- you won’t get more than a 4.2% increase in real estate assessed value (not including new construction) or approximately $300 million.

This would translate into a $1.8 million increase in revenue for the county. They don’t know what new construction will be yet. Last year there was about $130 million in new construction. Emerson worries that the litigation discussed earlier could offset some of the new construction gains.

Budget Planning Session

Adding to the previous conversation, George Zoettlein noted that there should be an additional $2.5 to $3 million in additional revenue to the general fund next year with the inclusion of revenues from new construction.

Zoettlein began his presentation by describing some budget policy changes to institute in order to prevent future budget shortfalls.

First budgeted revenues must equal budgeted expenses and balance forward cash is not included in budgeted revenues. The reserves are not included in expenses.

He stated that any balance forward cash should be used to fund the reserves. Additionally,

“If reserves needed exceed balance forward, expense budgets will need to be reduced. If balance forward exceeds reserves needed, the Board will determine how one time remaining funds are to be used.”

Zoettlein also recommended changing the budget submittal date for the Sheriff, Clerk of Court and Supervisor of Elections to June 1- per Florida Statutes. Currently they submit their budgets in May.

The commissioners were in favor of these changes.

Commissioner Allocco remarked, “It’s amazing how we can take something that should be simple: balance in, balance out and make it seem so confusing. I like the simplest budgeting method… I’m in favor of that.”

As far as the June 1 deadline, commissioners remarked that if they constitutionals are made to submit their budgets earlier, there are greater unknowns and naturally more padding will be worked into the budget to account for unknown costs. There will be less unknowns if they can submit June 1 instead of May 1. Commissioners voted 5-0 to repeal the ordinance which created the May 1 deadline- reverting the policy to June 1 deadline.

Commissioners were not in favor of giving the county administrator or a designee the ability to borrow money if “Equity in Pooled Cash” drops below an acceptable level with the commission being notified after the fact.

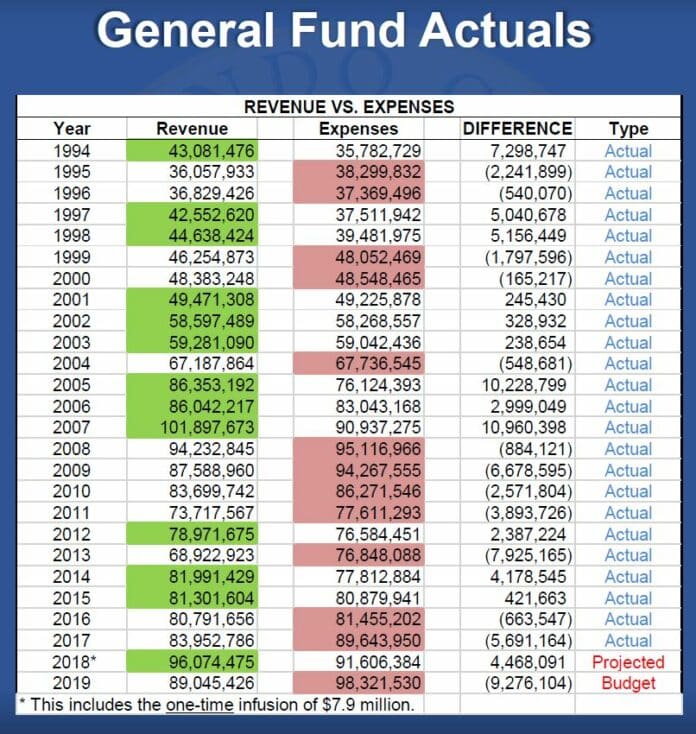

The fiscal year 2019 budget shortfall as of Jan. 8, 2019 was calculated to be $11,430,807. This takes into account the addition of the mid year adjustment of approximately $1.4 million in revenues and subtracts $3,587,644 due to an under-budgeted reserve from the balance forward cash: already negative $9,276,104.

Zoettlein provided general fund actuals since 1994 and a budget shortfall of $11 million is by far the largest within the 25 year time frame.

In order to reduce expenditures, he gave some options:

1. Reduce all budgets by given percent

2. Consolidation of Services

3. Close or move departments

4. Reduce reserves

Deputy County Administrator Rogers advocated for the consolidation of Information Technology Services by centralizing the department under the Property Appraiser’s office. He stated that he is looking at ways to minimize the potential millage increase due to the shortfall.

Commissioner Champion remarked that they should be looking at the big picture and decide strategy first. He reiterated that the board has been against raising taxes and asked “Are we going to cut $11 million all in one year? I don’t think the board will agree to that either. Maybe it’s over 3 years.”

“Then there’s going to have to be some tough cuts in all the departments based on percentage.”

The commission did vote in favor of having Rogers do more research on centralizing the IT department under the property appraiser.

Allocco pointed out that over the last few years they have had to defer capital improvements due to the annual percentage increase in salaries. He gave an example of the compounding effects of the salary increases.

“One high level position- 2014 it was running about $82,300. By 2018 that same position (same position not new responsibilities), $100,700. That’s a 20 percent increase and that does not include benefits. It adds up over time. We have to look at every peanut…”

A department which was singled out for potential closure was the Cooperative Extension- which would generate a savings of $325,000.

Moving departments to a Municipal Service Taxing Authority (MSTU) would remove their budgets from the General Fund, but commissioners are not too keen on it since it would be effectively result in a tax increase. Departments recommended for the MSTU include Little Rock Cannery, Chinsegut Hill, Library Services, Parks and Recreation Administration and Sensitive Lands. With a combination of MSTU and closure of departments, Zoettlein found a $6 million savings in the general fund.

Zoettlein also went through options on the revenue side including:

– Millage increase

– Payment in Lieu of Taxes (PILOT)

– Payment in Lieu of Franchise Fees (PILOF)

– Dependent Special District

– Borrowing funds

internally (Utilities Dept.)

Championed pushed the idea of a freeze on the general fund budget and a small percentage cut of all departments over a three year time frame.

The idea of a dependent special district for the Sheriff’s Office also generated some interest as they would be able to transfer the Sheriff’s Office reserves out of the general fund.

Zoettlein explained in regards to the $9.2 million in reserves, “We would upfront him the $9.2 million the very first year. In the second year it’s his responsibility to make sure he maintains that $9.2 million that we gave him. If he needs to use reserves, then he’d have to come to the board with a request. ”

At the close of the meeting, Chairman Holcomb summarized that the goal of the board is to hash out a three year plan going forward whereby at the end of year three, actual revenues and actual expenses are equal.

Attorney Garth Coller added that a “mechanism” in regards to the Sheriff’s Office reserves will be discussed with the Sheriff’s Office.