By LISA MACNEIL

[email protected]

At a special meeting held on July 9, 2019, the Board of County Commissioners (BOCC) learned that the current budget deficit could be potentially reduced by $627,931. The most recent goal was to reduce the deficit by $4 million. The board came to the consensus that they are not in favor of Payment in lieu of Franchise Fees (PILOF) or Payment in Lieu of taxes (PILOT) to generate revenues and gave County Administrator Jeff Rogers direction to construct a final budget within those parameters.

At this meeting the subject of the county admin building was addressed, albeit briefly. Including the admin building cost within the budget numbers, Stantec representatives showed that there is a temporary bump in revenue and reserves following the addition of 1 mil to the property tax rate. The bump would last until 2023-2024 when the reserves would drop below 18.5% once again. Commissioner Mitten asked for the admin building debt service to be removed, the tax rate set to baseline and removal of PILOF. The results showed consistent revenues greater than expenses through 2014, as well as surplus reserves after 2021. Setting the growth rate at 4% improves these numbers. Mitten suggested they consider a sales surtax to support the costs of the admin building, but no further discussion on the matter occurred.

The purpose of the special meeting was for the board to consider several possible solutions for discussion and direct Rogers in the finalization of the budget, which is to be reviewed in a future meeting. Millage rates and Constitutional budgets cannot be voted upon during this type of meeting.

Before Budget Director Stephanie Russ began the presentation, Hernando county citizens addressed the board to express their concerns, and offer suggestions such as raising millage or sales taxes. Among the citizens, Sue Loveday, who represents the Library Advisory Council, asked the officials to not cut any more funding to the library programs.

Answering the suggestion of raising the millage rate, Commissioner Steve Champion sought information from County Administrator Jeff Rogers to find if any other counties have raised their millage rates during what Champion terms, “an economic boon.” He then listed several surrounding counties with lower millage rates, adding that a raise in Hernando’s millage rate would put the county’s tax rate even with Pinellas.

Maintaining that cutting spending is the solution, Champion warned, “You don’t raise millage during an economic boon. Because this bubble is going to pop, and when it pops, the millage is going to have to go up.”

Commissioner John Allocco asked Rogers to expand the research and find out how many other counties actually created a deficit during the recent upswing in the economy. Allocco credits the current shortfall to “really bad budgeting” by previous boards and the current board. “The budget that was approved for fiscal year 2018 was a considerable portion of this lousy budget situation that we’re in today.”

Allocco added that if this county incurs storm damage this year, he does not know how recovery would be possible. “Keep that in mind going forward. Nobody likes paying taxes, but we can’t continue to run in a deficit, and create deficits during boons.”

Chairman Jeff Holcomb recalled concerns he’s had since his election in 2014. “Previous leadership created growth in this county of 4.5% … we cannot create enough revenue to overcome (that number). We covered recurring shortfalls by using unrelated capital accounts and reserves. We hired people to assist in covering this up. Those people failed to even keep that charade going. When the time was right, this board acted … we have new leadership now. The current leadership has done more in six months that the previous leadership did in seven years.”

Changes since the June 25 Meeting

Major Changes – Revenues

-Certified Taxable Value created an additional $1,489,471

-Cost Allocation created an additional $345,994

-Reverting Economic Development Grants Fund to the General Fund increased reserves by $785,247.

Major Changes – Expenses

-Taxable value increased expenses for the Tax Collector Commission, Brooksville and Kass Circle CRA (Community Redevelopment Authority) by $32,615.

-Repairs and maintenance for facilities increased $215,000

According to Russ, these were previously cut to “unrealistic numbers,” and hence needed to be increased for facilities maintenance to be viable.

-To fund annual playground equipment replacements, Parks and Recreation increased $200,000.

-Addition of $1.4 million for ERP (Enterprise Resource Planning) software replacement (70%, other 30% allocated to other funds – $2 million total cost expected)

Comptroller Doug Chorvat explained that this is the financial software used by five of the six constitutional bodies, and also includes features such as HR, purchasing and utilities billing. (Hernando County Sheriff’s Office (HCSO) uses different software.)

Currently, each department is paying $60,000 per year for maintenance and updates. With the new software, the $60,000 will cover all the departments.

-Allocation added for disaster recovery measures – $50,000

-Allocation to cover potential cash flow shortage Oct – Nov – $100,000 for LOC (line of credit) interest.

Reductions since the June 25 Workshop

3 vacant positions not being filled: $153,166

Three positions not being filled are Benefit Specialist, Purchasing Agent 1 and Health and Human Services Specialist.

County Administrative Org Chart changes (excluding funding the Community Services Director in 19/20) – a savings of $114,867

Recent changes to the county’s organization chart include a Community Services Director as a vacant position. Rogers changed the plan to fill this position only when and if funds become available. Champion restated his suggestion from the June 26, 2019 BOCC meeting, that one of the department heads shown under the Community Services Director be promoted into that role, while continuing to run that department.

The recommendation is to leave the position unfilled for now.

Reduction of the County’s Tuition Reimbursement program – $15,220

Reduction of cost to county for Employee Benefits – $68,551

Additional $10,182 various cuts made by administrator.

Directive By Board: Reduce $4 Million

– Revenue adjustments increased by $3,128,646

-Expenditure adjustments increased by $2,500,715

Increasing fund balance by $627,931

Current estimated reserves / fund balance is $4,163,532 at the time of this meeting, which is 3.8% of the budget, the BOCC policy is 18.5%.

The commissioners discussed that the title of this portion summarizes the changes, but does not reflect an actual reduction of the expenditures by the recommended $4 million. Rogers acknowledged this, and the fact that the increased expenses realized since the June 25 meeting actually “makes things a little harder.”

Champion expressed concern that the effort is resulting in a very small change, barely reducing the deficit. “60-plus percent (of expense) is the Sheriff and the jail, so let’s talk about that. (The BOCC) is 20 percent. You can cut the entire budget for the county, fire everybody, and you’re still going to be in a deficit.”

Champion suggested that the Sheriff should be included in future budget discussions. Major Kirk Turner and Comptroller Terri McClanahan later joined the board, with Turner beginning by assuring the board that the budget submitted by the Sheriff was “reasonable and necessary.”

McClanahan advised the board that there was a discrepancy in the budget book that was submitted and she brought a paper to the podium. McClanahan reported a $2.8 million increase, rather than a $6.8 million increase. She added further that, much like the BOCC, HCSO deliberated over cuts before their final submission as well, leaving few questions for the board.

Level of Service Reductions

Rogers stated that these were not necessarily recommended, however they are options.

Vacant Positions

Code Enforcement $56,900

Library Services Assistant $36,000

Combining / Outsourcing of Departments

Reductions of Library

Close the West Side Library:

-Spring Hill Library to serve the West side of the county

Keep building, have to determine if long term will desire to have this library open again

East Side / Brooksville Library reduced hours:

-Customer service staff in Brooksville and Eastside will work in both locations. Brooksville open 3 days, Eastside open 3 days.

Estimated savings: $500,000

The commission discussed the possibility of a referendum to have residents vote on their desired level of service.

County Administrator Solution

-Addition of PILOF from utilities: $2.4 million

-Increase of Millage of 1 mil: $9,117,516

-Create Municipal Service Taxing Unit (MSTU) in FY 2021 for Parks, Recreation and Library

-Further reducing expenses and streamlining processes without impacting services.

At the time of this printing, the actual budgets were not available. Commissioner Champion mentioned this twice during the meeting, and directed that all papers that the commissioners were reviewing and referring to be placed online for public availability.

Erick van Malssen and Peter Napoli from Stantec were present and applied new information to their interactive model of the county’s financial outlook. Keeping the ‘Admin building” variable set to “Y (yes-included in the budget)”, they demonstrated that adding the PILOF would have little effect on increasing revenue over expenses, but adding a 1 mil increase would have a significant effect on revenue and would bolster the reserve fund. Temporarily.

Stantec’s analysis shows expenses edging out revenues again sometime in 2023-24, as well as a reduction in reserves that would fall below the 18.5% line.

However, further limiting the county’s growth factor by 3.5% would eventually see a reserve surplus, which could then reverse millage increases. According to Rogers, it’s not an easy task. Each year, the county would need to “find efficiencies and reductions” to counteract the rising cost of necessary expenses.

Commissioner John Mitten asked for the graph view, setting the millage back to baseline, removing the PILOF and also removing the debt service for the admin building. The results showed consistent revenues greater than expenses through 2014, as well as surplus reserves after 2021. Setting the growth rate at 4% improves these numbers.

Mitten also suggested a sales-tax referendum for construction of the new government building, however no further discussion took place.

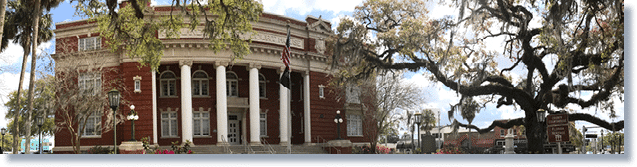

Clarification on the proposed government complex

Because details have not been discussed in regards to the admin building/ government complex referred to in this presentation as well as the first presentation to the county commissioners by Stantec, we reached out to the county for particulars on the project. Both presentations have shown that the building is a significant cost burden on the county’s already fragile financial situation, but no details were provided on what the new administration building is or how they came up with the $37 million cost.

According to documents we received, the new government complex would consist of 104,000 square feet, dedicated to the BOCC and Constitutional Offices as well as warehouse space. It is projected to serve a total staff of 215 in the year 2026. The total cost of the project including debt service would be upwards of $70 million. A level debt service scenario comes out to $72,329,917 and a wrapped debt service scenario is $76,871,250. Both assume a principal of roughly $37 million. The final payments would be made Sept. 30, 2049.

In the last several years, many solutions to the county’s space needs issues have been posed, with cost estimates ranging from $15 million (the PineBrook solution) to $130 million (CGL Company’s long-term government facility and courthouse expansion project ).

So far the government complex project has not been put out to bid. If the government complex at $70 million plus is part of the county’s future plan, it will most likely necessitate raising taxes. If Stantec’s financial model is accurate, then it will have to be more than just a 1 mil increase in property taxes.

Julie Maglio contributed to this report.