When a business owner first opens shop, there is one thing he or she must remember – starting and operating a small business is a team sport. One of the biggest mistakes a business owner can make is attempting to do everything on their own. You can’t do everything on your own –no one can.

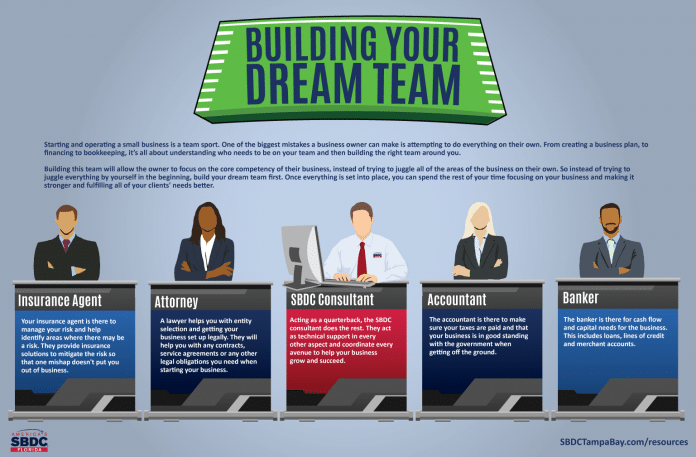

From creating a business plan to financing to bookkeeping, it’s all about understanding who needs to be on your team and then building the right team around you. The five key players you need to fill out your first-round draft picks and the roles they play are:

Attorney – A lawyer helps you with entity selection and getting your business set up legally. They will help you with any contracts, service agreements or any other legal obligations you need when starting your business.

Accountant/Bookkeeper – The accountant is there to make sure your taxes are paid and that your business is in good standing with the government when getting off the ground.

Banker – The banker is there for cash flow and capital needs for the business. This includes loans, lines of credit, and merchant accounts.

Insurance Agent – Your insurance agent is there to manage your risk and help identify areas where there may be a risk. They provide insurance solutions to mitigate the risk so that one mishap doesn’t put you out of business.

SBDC Consultant – Acting as a quarterback, the Small Business Development Center (SBDC) consultant does the rest. They act as technical support in every other aspect and coordinates every avenue to help your business grow and succeed.

Many business owners who are just starting may worry whether they can afford to invest in this team when they are starting. Honestly, they cannot afford not to. A business owner must include any service fees in its original business plan. For example, every business needs a lawyer to help set up a business. Even if they are not put on retainer for future use, a reliable, trustworthy lawyer is needed to make sure the language in the business articles, corporation and organization are legally sound.

Some new business owners may believe that they can file taxes and do all of their accounting in-house, and they can in the beginning when it’s at a basic level. However, once employees are hired and the business starts to grow, the owner soon realizes that they are responsible for payroll taxes, sales taxes, corporate withholdings and estimated payments. It’s going to get complicated quickly. It’s not only a timesaver to outsource these responsibilities to an accountant, but if a mistake is made, it could be a very expensive mistake. With the areas of omissions clause, the accountant will responsible for those mistakes, not the business owner.

Building this team will allow the owner to focus on the core competency of their business, instead of trying to juggle all of the areas of the business on their own. This way, you’re not spinning your wheels trying to do what your teammates should be doing. That doesn’t work on a basketball court, on a football field or a soccer field, and it won’t work in your business. If you’re trying to do the other guy’s job then something else is being neglected and not getting done, and the business will not be successful.

Once you build your team, it is important to remain a team. This requires building strong relationships with your teammates. You should be on a first-name basis and have a direct way to contact every team member. Do not hire from a mystical 800 number that transfers you to some offshore call center for support. You need to have a local banker, lawyer and even a local insurance agent to cover you in all of these areas.

Because you need to find reliable, trustworthy and preferably local teammates, do not try to draft your team from a Google search. The person with the best SEO or the best Google AdWords strategy isn’t always the best provider of professional services. They just happen to be the best marketer of those services. Your quarterback – your SBDC consultant – is there to help connect you with team members that specifically meet your business’ needs.

The Small Business Resource Network (SBRN) is also a great resource for business service providers. Other sources can include your local chamber of commerce, and never discount the advice of family and friends.

So instead of trying to juggle everything by yourself in the beginning, build your dream team first. Once everything is set in place, you can spend the rest of your time focusing on your business and making it stronger and fulfilling all of your clients’ needs better.

Carl Hadden is an associate director and business consultant at the Florida SBDC at University of South Florida.