By JULIE B. MAGLIO

julie@hernandosun.com

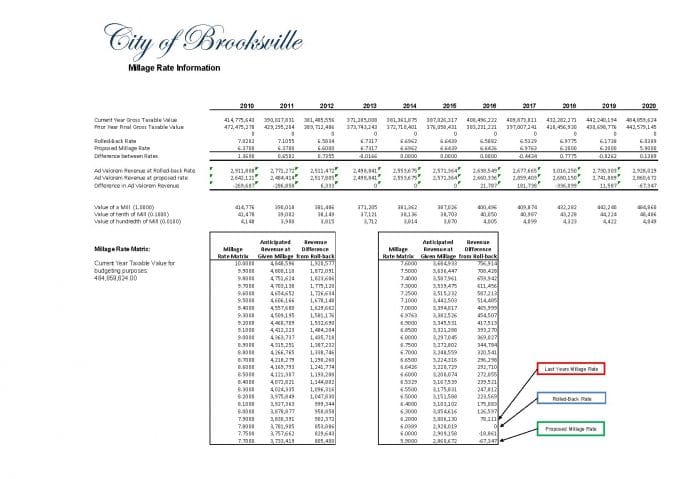

On Sept. 3, 2020, the city of Brooksville held their first millage rate and budget hearing after a series of several budget workshops throughout the summer. City council considered a millage rate of 5.9 mills resulting in a tax decrease as 5.9 mills is below the roll-back rate by 2.3001% (roll back rate is 6.0389). A budget was also considered which includes funding for special projects, employee pay raises as well as the highly discussed Brooksville Main Street program.

The city provided a list of changes and updates to the departments and funds since the August 24th meeting. The items are as follows:

Ad Valorem is at 5.9000 mils

Changed wage increase from 2% to 4%

Business Development Dept – $22,500 contribution and $8,000 for street closures was added to the Contributions line item.

Parks Dept – Removed the duplicate project for the Tom Varn Park Playground $150,000

Park Dept – Part-Time Park Attendant I was added – $15,972 wages and benefits – During the 07/13/20 meeting a Part-Time Park Attendant I was approved to be added. It was not added to the budget shown for the 08/24/20 meeting.

Fire Dept – Added one possible payment for the Fire Truck Loan – $17,733

Projected Revenue for FY 19/20 – $270,000 was added to the projected reserve for FY19/20.

A budget message from city manager Mark Kutney was included in the agenda item documents and provides an overview of what the city’s Fiscal Year 2020-2021 budget will look like:

———-

Please allow this Budget Message to serve as the formal transmission of the proposed Budget for Fiscal Year 2020-2021. This budget reflects the City Council’s vision in moving the City boldly into the future. This Budget is a reflection of numerous City Council initiatives that have been identified and are in progress during the present fiscal year and will continue during the 2020-2021 Fiscal Year. The formulation of this budget is largely representative of City Council special meetings that were held on May 11th, June 24th, July 13th, August 10th and two special meetings on August 24th. As the City Council is aware, in municipal government, the adoption of the annual City Budget is one of the biggest decisions that an elected body will make.

Budget Overview

The FY 2020-2021 Budget is representative of a spending plan that was fashioned in spite of numerous challenges that occurred during the current Fiscal Year.

COVID 19

The City of Brooksville was confronted with an unprecedented event during the Fiscal Year that started in February and began to dominate in March. That event was the worldwide COVID 19 pandemic which triggered a shutdown of activity within the country. As a result, the pandemic caused numerous closures and shutdowns, cancellation of a multitude of events and the loss of revenue in several areas. For example, the City is still under a State of Emergency Declaration that was enacted on March 16, 2020. While City employees continued to work and provide services and conduct the business of the City, City Hall and other business offices of the City were closed to the public. City offices were reopened in phases consistent with the Governor’s phased reopening process.

Revenue Loss due to COVID 19

In terms of revenue losses, the City absorbed losses in three areas. At this point in time, the city projects a state revenue loss of $52,129 and Parks and Recreation losses of $35,000. These revenue losses impact the general fund and special revenue funds 107 and 108 pertaining to local option gas taxes. Utility revenue losses are projected to be $48,433. These revenue losses effect Fund 401, Water and Wastewater.

Projects Impacts Due to COVID 19

Perhaps the biggest consequence of the COVID 19 pandemic was the stoppage and delay of multiple projects that were slated for implementation and completion during this fiscal year. Staff has attempted to move forward on these projects and the projects are currently underway. However, most of these projects will not be completed until and during the FY 21 and the funds have been carried over to FY 21.

Certified Taxable Assessed Valuation and Millage Rate

The City of Brooksville certified Taxable Assessed Valuation for calendar/tax year 2020 is $484,859,624 which is an increase of $42,619,430 over the prior year. On August 24, 2020, the Brooksville City Council set the millage rate at 5.9 mills which is a reduction from the prior year of 6.2 mills.

Personnel

The city continues to ensure that the provision of services is addressed. In this proposed budget two (2) full time and two (2) part-time positions are proposed. All four positions are found in General Fund and include: A part-time Administrative Specialist III in the City Manager’s Office; a part-time Park Attendant in Parks and Recreation; a Code Enforcement Officer in the Development Department; and an Economic Development Specialist in Business Development within the City Manager’s Office.

Capital Budget

For FY 2020-2021, a number of projects were identified and added to the Budget. Some of these projects include: The upgrading of the audio, video/presentation hardware in City Council Chambers; Cemetery expansions, Jerome Brown Center parking lot repairs and repaving; Tom Varn wood playground replacement; Lamar water plant, milling/resurface program; and modification of the master lift station at Cortez Blvd. The aforementioned projects display the City’s commitment to moving forward with capital improvements.

Economic Development/Community Redevelopment Agency

The FY 2020-2021 Budget also demonstrates the City’s commitment to economic development. As previously mentioned above, the City is adding an Economic Development Specialist and Code Enforcement Officer to assist with Economic Development efforts. On July 28, 2020, the City Council accepted the City Manager’s economic development strategic plan. In addition to the cited positions, this budget provides $94,000 dollars in additional expenses for Economic Development endeavors. The City will also revisit the Community Redevelopment Agency (CRA) as part of the overall economic development program to ensure that the CRA furthers economic development. The CRA will initiate future assessments to the CRA plan and ensure that future CRA spending and initiatives will be productive.

Other Budget Initiatives

In the proposed FY 2020-2021 Budget, the City will be providing its employees with a four (4) percent wage increase. The City will also be funding the Brooksville Main Street Program at $22,500 with an additional $8,000 for street closures related to Main Street activity. The City is continuing its Law Enforcement Contract with the Hernando County Sheriff’s Office (HCSO). The FY 2020-2021 contract calls for an annual cost of $882,219 after offset for lease credits and capital outlays.

Budget Conclusion

In closing, I would like to thank the City’s Management Team for their hard work on the budget and particularly the Finance Department and Autumn Sullivan for their efforts during this process. I appreciate and thank City Council for their review and contributions in providing direction and guidance relative to policy matters as the City moves forward. Many difficult issues were reconciled during this budget process. This budget represents an ambitious policy/spending plan that is based upon business initiatives that will carry Brooksville into the future. It is a budget that when implemented will position the City to continuously improve, grow, and move boldly into the future.

———–

First reading of FY 2021 millage rate and budget ordinances

The fiscal year 2021 recommended millage rate

The motion to adopt the first reading of the millage rate at 5.9000 was approved 4-1 with Kemerer voting no. Prior to the vote, Kemerer urged for a further millage rate decrease to 5.4.

The fiscal year 2021 recommended budget

After a motion was made for approval of the first reading of the fiscal year 2021 budget, Vice Mayor Brayton urged council to consider a 5% employee salary increase so that the finance director can further evaluate costs. Erhard was the only other council member to support the change so no further changes were made and the motion to adopt the first reading of the FY 2021 budget passed 4-1, with Erhard voting against it.

A second reading of the fiscal year 2021 budget will be Sept. 16, 2020.