By LISA MACNEIL,

[email protected]

Budget Director Toni Brady presented the county’s final budget with its changes to the Board of County Commissioners (BOCC) Sep 28, 2021. While the overall budget remained the same, an addition of $50,000 for the Enrichment Center for fiscal year (FY) 2022 was approved on September 14th. These funds will come from the Reserve fund, thereby reducing it by $50,000.

These funds for the Enrichment Center are expected to be a one-time allocation.

The final budget of all county funds amounts to $621,809,788.

The board voted unanimously to reduce the General Fund millage rate by 0.1 mill, and put additional revenues into reserves. Commissioners hope to continue dropping millage rates in the next fiscal year. Although the millage rate will be lower than last year, it is not below the roll-back rate and will bring in more tax revenue than last year, so technically it is a tax increase.

The new aggregate millage rate will be 9.3844, a 4.15% increase over the rollback rate of 9.0103.

Brady reported the county understated the taxable value during the first budget hearing by using the Current Year Adjustable Value, which does not include the Current Year New Taxable Value from construction, additions, improvements, etc. The Current Year Gross Taxable Value should have been used. This resulted in an additional $2,318,254 in Ad Valorem revenue.

Taxable Value used for Budget Process:

$10,497,083,663

Revised Taxable Value for Budget Process:

$10,754,376,118

Net Difference (New Taxable Value)

$257,292,455

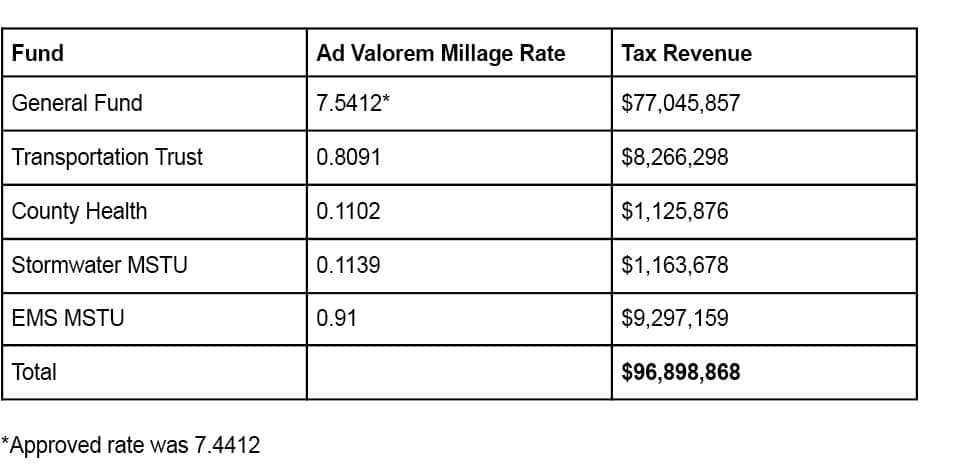

See the chart below for the Revised Estimated Ad Valorem Tax Revenue

Using the $10,754,376,118 at 95% of Tentative Budget

(Recognizing the additional $2,318,254 increases revenue from the tentative total of $94,580,614)

The board was given the option to reduce general fund millage by 0.1 and put additional revenue in the capital or contingency reserves for each respective fund. The Transportation Trust will receive the greatest portion.

Final millage rates:

General Fund: 7.4412 2.15% over the rollback rate of 7.2592

County Health: 0.1102 5.25% over the rollback rate of 0.1047

Transportation Trust: 0.8091 20.10% over the rollback rate of 0.6737

Commissioner Steve Champion explained that the 0.1 transfer of millage from the General Fund to Transportation trust, “(Transporation Trust) is a small account, that’s why it’s got a huge number (percentage over rollback), not because we want to increase spending by 20%. It’s a small number overall.”

MSBUs have not changed since the tentative meeting.

The recently passed Local Provider Participation Fund aims to close the payment gap to hospitals that receive Medicare and Medicaid funding. The following will be placed into a special account, and receive a match from the state, plus $0.27.

There is no financial impact to the county.

Facility

Rate (Of Net Provider Revenue)

Mandatory Payment

Bayfront Health (Brooksville and Spring Hill

3.53%

$4,507,002

Encompass Health Rehabilitation Hospital of Spring Hill

3.53%

$1,245,933

Oak Hill Hospital

3.53%

$9,232,669

Springbrook Hospital

3.53%

$559,707