Going to war is expensive. Did you know that the cost of WWII exceeded 300 billion dollars? Adjusted for today’s inflation that would be over 4.1 trillion dollars! How could the US government pay off such a large debt? One way the US tried to do this was to appeal to our patriotism and civic duty by implementing war bonds.

Bonds were nothing new. This form of government loan had been used before, most recently with liberty bonds in WWI. The new bonds were called defense bonds and came on the market on May 1, 1941. FDR purchased the first one. They were later called war bonds following the December 7, 1941 attack on Pearl Harbor.

War bonds gave the government quick access to large amounts of capital. The bonds were sold in dominations ranging from $25 to $1000 and the public purchased them for 75% of face value. For example, a $25 bond cost $18.75. Then you held the bond while it matured and earned interest. The rate of interest was usually lower than the prevailing market of the day, which was less than 3% at the time. War bonds also took 10 years to mature and at the end of term you could cash them in and receive the full amount.

There were extensive promotional campaigns for war bonds. Employees set up payroll deduction plans so workers could contribute. Even children even got involved! They could purchase special 10-cent stamps (or 25-cent ones) at school and paste them in an album. Can you imagine how many weeks it took until a full album was exchanged for a War Bond?

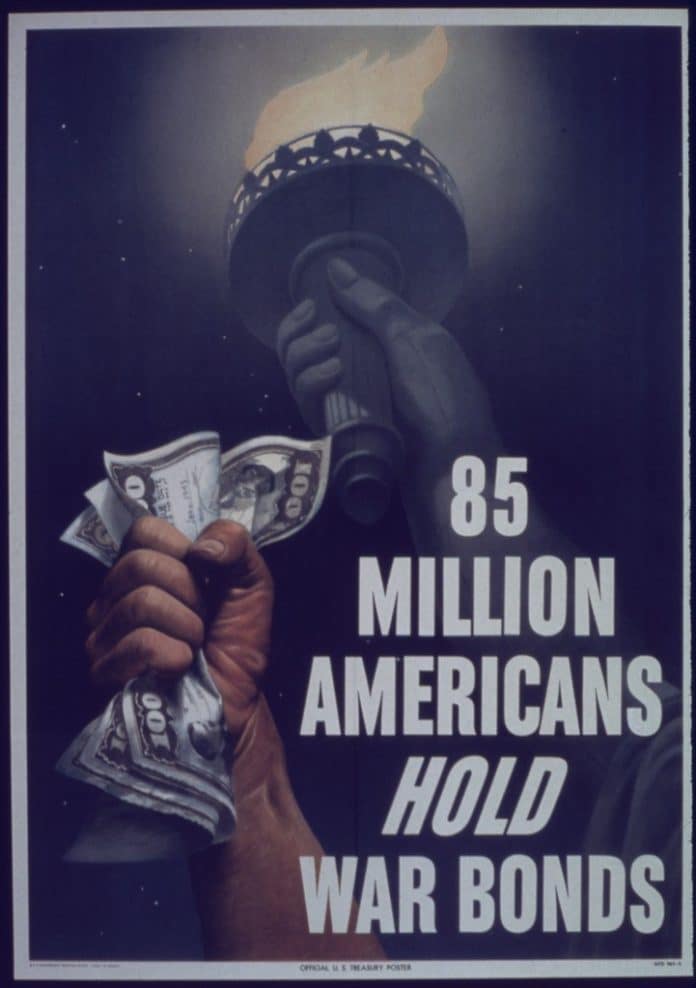

There were war bond ads in newspapers, magazines, and even comic books. Superman and Batman talked about war bonds, can you believe it? Film star James Cagney made a short commercial about war bonds. You heard about bonds on the radio. Celebrities held rallies for them. Movie houses and stadiums offered free admission on certain days with the purchase of a war bond. Absolutely everywhere it was stressed that each American should do their patriotic duty and buy a bond!

Ordinary men and women played a great part in the success of war bonds. There were eight door to door war loan drives between 1942-1945. Can you imagine someone knocking on your door to talk you into buying a bond? By the end of WWII over half of all Americans (some 85 million people) had purchased war bonds! Of the total who bought bonds the average amount spent was $2000 per person. Back then that $2000 was the equivalent of a year’s wages!

An excerpt from my Uncle John’s Letter of August 29, 1944, read:

“We had a wonderful carnival on this past Sunday evening. There were all sorts of …games. The money was all script money furnished to all who bought a chance for this bond drive. Also had hamburgers, hot dogs, and pop (a revival of old times). Then we had drawings for the bonds. Chances were sold at 20 cents a chance which made one eligible to get these bond prizes considering we bought a war bond. The bond prizes were 1—$500, 1–$100, 1—$50, and 10—$25. Our hut was fortunate in winning one of the $25 bonds–one of the boys in our hut was one of the lucky ones. ”

Along with the carnival, they also had an auction on base. Some of the items for auction included watches, lighters, whiskey, and sports memorabilia. All the proceeds then went toward war bonds. My Uncle John’s particular unit achieved 116% of its fundraising goal. Some men spent quite a bit!

As in every letter, my Uncle John mentions his wife, Mil. She was the love of his life. An excerpt from Uncle John’s Letter of August 29, 1944, read: “Did you receive the $10 money order I sent you to buy my darling flowers for our anniversary?

A second way for the government to raise money for the war effort was in the establishment of a victory tax. They proposed a 5% additional income tax for all workers making more than $624 annually. It was the broadest and most progressive tax in American history at the time. And It actually was a voluntary tax, but most of the public wasn’t aware of that. Most went along with it as a patriotic duty. It went in effect when legislation was passed the Revenue Act of 1942. Before WWII paying income tax only affected a fraction of the total population, just the top wage earners. In 1939 only 15% of the population paid income tax.

Having the victory tax almost doubled the number of individuals required to pay income tax. And it did so in a hurry! In 1943 there were 40 million tax returns submitted, compared to 26 million returns the previous year! By the end of WWII, some 80% of the population paid income tax. This gave the government quick access to large amounts of capital. It was certainly needed for the war effort. Money was available to fund the purchase of ships, aircraft carriers, tanks, weapons, equipment and supplies.

How long did this extra 5% last? It was in effect for two years and was eliminated by the Individual Income Tax Act of 1944. New legislation got rid of the 5% victory tax, but raised the overal income tax for the individual. Today we still see the result of this legislation each time we pay our IRS withholdings. The tax form 1040 for the year 1943 has several lines devoted to victory tax. Short on funds that year? No problem. Tax forms also had a line about deferring up to half of the victory tax until March 15, 1945.

Walt Disney was even asked to help promote the victory tax. In 1942 he made a short film “The New Spirit” in which Donald Duck goes to Washington D.C. to learn about taxes. Disney also made a cartoon the following year called “Spirit of 43,” which some call war propaganda. In the cartoon, a “good duck” personality wrestles against a Hitler-like “bad duck.” In the end, the “good duck” wins and then rushes off to pay his taxes.

An excerpt from my Uncle John’s Letter of December 18, 1942, read:

“I’ve read where we are involved in a victory tax, too, just as you are in the states. This is supposed to take effect starting the first of the year.”

That was the only mention I found regarding the tax. He continues to write each week no matter what. In this next letter he mentions more about daily life and comments on his health. Just a bit of chit-chat. Sometimes I almost forget he’s in the middle of a war. Meanwhile, he tries to keep up with news at home and often mentions movies, newspapers, and magazines.

An excerpt from my Uncle John’s V-Mail from February 21, 1943 read:

“I am in the best of health and I do feel years younger from all the walking I do, our food is still wonderful, in fact we have some new bakers who can really make a variety of cakes, and you know that is my dish. We even had chicken dinner one Monday. I really can’t complain of the food, seeing I am rather a fussy eater and I say the meals are good, that means an awful lot. I still weigh around 170 pounds. Two other boys in my hut have had someone subscribe for the ‘Times’ so now we may be able to get a full set of papers. One also gets the Saturday Evening Post and the Reader’s Digest.”

I often wish I had more of Uncle John’s letters. I’d love more thoughts about the war bonds and the victory tax. My uncle’s letters often make me think about all those that sacrificed for us. Thru bonds and taxes many Americans gave their support to the war effort so we could have the freedom we have today!