Hernando County held a budget workshop on July 5, 2022. Budget Director Toni Brady presented the recommended budget for Fiscal Year (FY) 2022-2023, using a new interactive site, available to the public at: stories.opengov.com/hernandocountyfl/published/yxZtOAE-2.

At the regular BOCC meeting on July 26th, 2022, commissioners set the maximum Millage Rate for FY-23 at 7.1412, a reduction of .3 points. Next year’s rollback rate is 6.4949. The rollback rate refers to the rate where the county would be collecting an equal amount of tax revenue as the previous year. Although the millage rate will be lower than last year (7.4412), it is not below the rollback rate and will bring in more tax revenue than last year, so technically it is a tax increase.

A first Public Hearing on the budget and Millage Rate is scheduled for September 13. On September 27, the final budget will be approved and the Millage Rate set.

Budget Highlights

• Total Budget $647,425,424

• General Fund Reserves $47,215,244

• Judicial Center Remodel $21,500,000

• Constitutionals $85,804,458

• 2nd payment American Rescue Funds $18,833,344

As usual for most budget years, requests for most funds have increased. The county also received a second ARPA (American Rescue Plan Act) grant of $18,833,344.

The total budget can be broken down into the following categories:

Fund

Enterprise $218,335,709

General $188,492,209

Special Revenue $176,069,836

Internal Service $44,305,749

Capital $18,177,889

Debt Service $2,044,032`

The Enterprise fund is funded in part by utilities, solid waste, and airport revenues. The Special Revenue Fund is comprised of MSTU (Municipal Service Taxing Unit) and MSBU (Municipal Service Benefit Unit) funds, and fuel taxes, and presently includes the ARPA funds.

The Capital fund consists largely of Impact fees.

Budget Assumptions

Certified Value Increase of 18.82%

Millage Reduction 0.2

Revenues Budgeted at 95%

BOCC Employees Salary Increases of 3.0%

BOCC Employees in Teamsters Local 79 Union Salary Increases of 3.0%

BOCC Employees in IAFF (International Association Of Fire Fighters) Local 3760 Salary Increases of 3.75%

Increase Benefit Dollars by 3% ($289,176)

Minimum Wage to $11.00

Brady explained that the rate of 95% for budgeting revenues is due to discounts given to individuals who pay their taxes early. The Certified Value Increase is the percentage change of home values from the previous fiscal year. The 18.82% increase calculated for this fiscal year is more than double that of FY-21-22, which showed a 7.82% increase. Years 2014 – 2021 showed yearly growth after two years of losses in home values following the 2008 recession.

Rogers addressed the minimum wage increase to $11.00 per hour in 2023. He has proposed approximately $70,000 to increase the salaries of veteran staff and managers to reflect the difference between their salaries with respect to the minimum hourly wage. Rogers is planning to request funding for a Wage Compression Study to learn how to best handle this phenomenon, defined most simply as a situation where more senior employees earn less than new hires for the same position.

The County’s Funding Focus

• Maintain/Increase Reserves

• Economic Development

• Maintain Fund for Storm Recovery ($884,000 current balance)

• Prioritizing Recovery Act Funds

• Improve Service Efficiencies by maintaining levels of service for all areas to meet increasing demands due to community growth.

The Economic Development Department will see an increase in personnel costs due to its acquisition of a Business Manager. The Stormwater Recovery fund is a part of the Solid Waste Disposal Assessment and ensures that recovery from a major storm is less dependent on the General Fund.

Efficiencies and improvements to service delivery are reportedly due to new software installed across various departments.

Other items of significance discussed pertained to increased services due to continued growth as more people move into the county. Another facet of concern is that an additional homestead exemption will go into effect for First Responders and Teachers, biting into ad-valorem revenues.

A recession in the near future has been in various headlines and mentioned during recent BOCC meetings as well. Commissioner John Allocco commented that capital projects may be a prudent focus should the economy recede, explaining, “There will be no better time to get road projects done, and [others] than during a recession because you provide jobs in your community, and you can get it at a cheaper price than during the boon … let’s make sure that we put ourselves in the best position, that if the recession hits, [materials] will be more readily available and the prices reduced.”

Topics of Discussion: Animal Services

Animal Services is requesting funds to allow for the Kennel Worker position to increase to full-time. The department also seeks to hire a Kennel Worker / Veterinary assistant. The total budget for these personnel changes is $67,557.

Animal Services Director James Terry told the board that fines levied by the Special Magistrate should increase revenues in the Animal Services department. However, Terry estimates that the department has over $1 million in unpaid fines. A problem for years, Terry said, “Typically [the county] can put a lien on property, but we have such a large percentage of people in violation that don’t own anything, so how do you put a lien on a home?”

Assistant Attorney Kyle Benda stated that a lien can currently be attached to the property to be dealt with by the property owner. The matter could come back to the BOCC at a later date.

Hernando County Fire and Emergency Services

Deputy Fire Chief Jim Billotte is requesting 4 single-certification Paramedics at the cost of $65,364 each. These Paramedics are only certified for medical duties and are not cross-trained or certified as Firefighters.

These Paramedics will staff a peak-hours ambulance unit, which will be in service during those hours of increased calls for service. The peak-hours Paramedics will work 10-12 hour shifts rather than the 24-hour shifts usually staffed by Firefighter-Paramedics

The “Green-Red Chart”

The star of all the slides and bullet points is the simple spreadsheet that shows whether or not the county’s revenues have exceeded expenditures in the past, and how they expect to do in the coming fiscal year. This year’s chart shows history back to 1994. Visitors to the opengov.com site (stories.opengov.com/hernandocountyfl/published/yxZtOAE-2) can also see vertical bar charts using the Green-Red data.

As of this writing, FY-22 is showing that expenditures exceeded revenues by roughly $7.8 million, which includes $17 million in scheduled capital projects. The FY-23 estimate shows a shortfall of over $3.2 million with $14 million in capital projects.

Champion compared current expected revenues to that of 2007. Then, home values pushed the county’s revenues over $101 million. “When you see the peak in ‘07, then you look at how it dropped 30%. If you look at this now, if you have a 30% drop, you’re going to have a $40 million downturn if anything even remotely even close happens that happened before … It’s got to correct itself. It can’t keep going up forever.”

Commissioner John Allocco countered that more homes purchased currently are purchased without a mortgage. “[Owners] are not going to walk away from a $350,000 cash investment. The values may decrease, but [owners] aren’t going to walk away and have a massive foreclosure market.”

Adding to the reasons why 2023 won’t look like 2007, Commissioner Jeff Holcomb remarked that more homeowners have double the equity in their homes as compared to the owners of 2007.

Clerk of Court

The Clerk’s office will see a rise in employee expenses as it absorbs two extra departments. The County Government Broadcasting and Fire and Emergency Services IT (Information Technology) Services will now be directed by Doug Chorvat’s office, and result in an increased 8.4% increase in personnel expenses.

Chorvat also explained that his department has incurred more capital costs since taking over the Technology department in recent years. He also reports contending with supply and demand issues, citing, “Some of the things we ordered last April (2021) didn’t come in until February (2022). So this year, we actually have some things that are budgeted twice. So if they come in this year, that money comes back …”

Other expensive technology is also affecting this budget. Chorvat explained that a Cisco phone system will be placed in service next year, affecting every department except HCSO. This phone system will also service the Health Department. E911 services are currently not in compliance, which the office will address in the next year.

Hernando County Sheriff’s Office (HCSO)

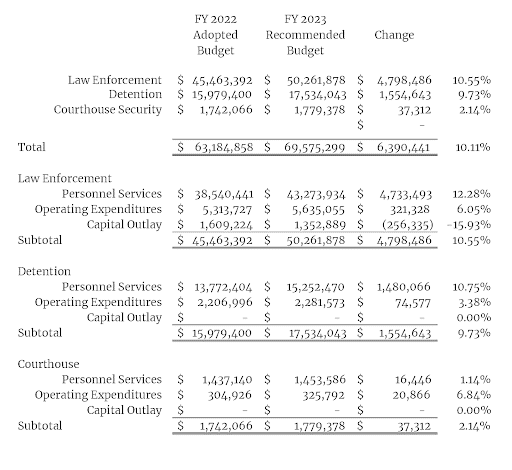

HCSO’s budget shows the largest increase in Law Enforcement Personnel Services at 12.28%. The total recommended HCSO budget for fiscal year 2023 is $69,575,299. This increase is due in part to salary increases in neighboring counties, prompting Hernando to increase salaries in order to remain competitive. Increases in civilian salaries are also on the rise.

The Sheriff’s budget sees a decrease in Capital Outlay by 15.93%. The reason for the decrease was not indicated.

Notable Capital Improvement Projects

• Tax Collector’s Office – Westside

• Public Safety Training Complex

• Hernando Beach Boat Ramp Parking

• Airport Industrial Park Improvements

• Splash Park – Anderson Snow

• South Brooksville Drainage

• Barclay Road Improvements

• Peck Sink Improvements

• Glen Wastewater Treatment Plant Upgrades

• Wiscon Water Treatment Plant

• Killian Water Plant Upgrades

• Road Resurfacing Program ($10+ million)