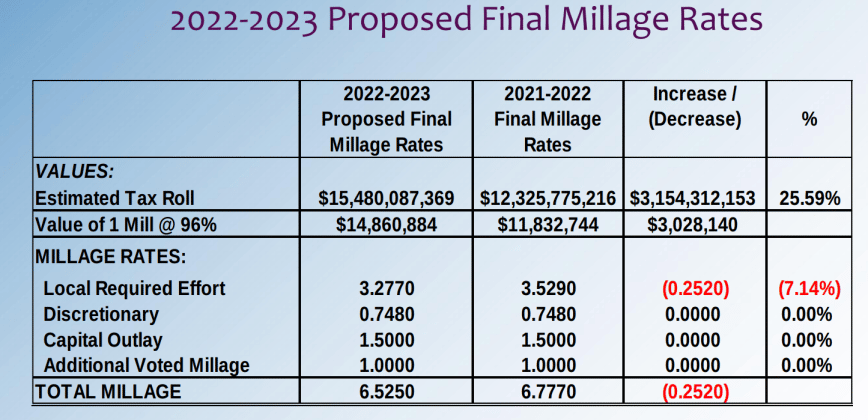

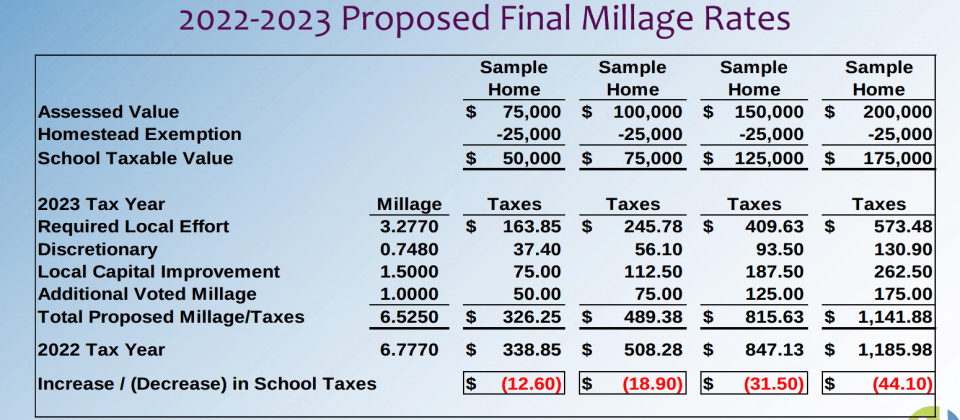

The Board members of the Hernando County School District (HCSD) voted 5-0 at the September 6, 2022 meeting to approve the proposed budget for the 2022-23 school year. The adopted total millage rate for FY 2022-2023 is 6.5250. There has been no change in rates from FY 2021-2022 other than the state-controlled Local Required Effort (LRE) which dropped 7.14%. While the total millage rate decreases by .2520 due to the LRE drop, taxpayers are likely to experience an increase in tax payments as the district expects to collect an additional $16.7 million in tax revenues in FY 2022-2023. The total millage rate required to collect the same amount of taxes as in FY 2021-2022 is 5.396 (also called the roll back rate). The adopted millage of 6.5250 is over 1 mill higher than the roll back rate.

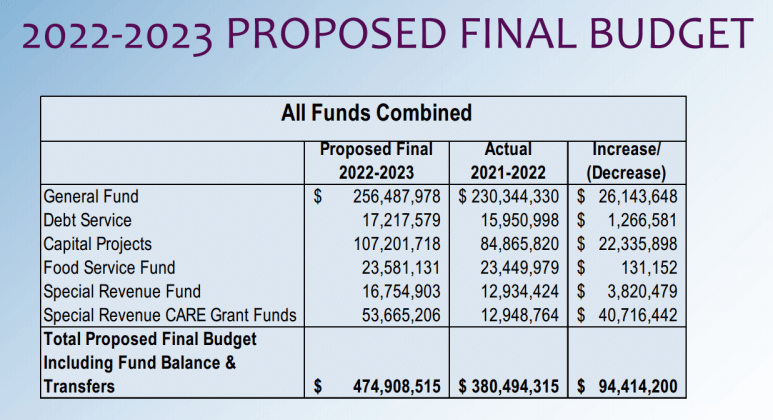

Joyce McIntyre, Director of Finance and Director of Budget Kendra Sittig, presented the final budget proposal, showing an expected overall increase in all funds of $94,414,200 over the previous school year. The total budget including fund balances from the previous year and transfers is $474,908,515.

The Federally-funded CARES (Coronavirus Aid, Relief, and Economic Security) Act funds will add $53,665,206 to the HCSD revenues. These funds are specifically to be used for salaries and benefits ($11,899,255), purchased services ($5,429,108), energy ($185,000), materials and supplies ($6,351,901), capital outlay ($29,143,108) and other expenditures that were not specified ($656,833).

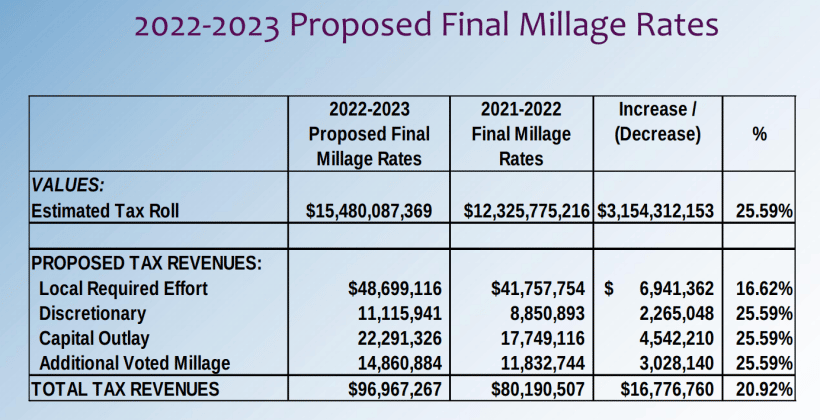

Also adding revenue to this school year’s budget is the recent 1.00 mill millage rate increase. The tax increase will provide the school board with an extra $14,860,884 to use for school facilities construction, maintenance and repairs.

Additionally, each Florida school district is subject to contribute a Required Local Effort (RLE), which is the amount required by state law to provide toward the cost of the Florida Education Finance Program (FEFP). FEFP funds are for operating costs. McIntyre reported, “On July 19, 2022 the Commissioner of Education certified the Required Local Effort (RLE) millage rate of 3.277. This rate must be levied by the School Board to generate the RLS.” The RLE has decreased 7.14 percent from the 2021-22 school year.

Hernando County’s estimated tax roll has increased by 25.59 percent from the previous year, to over 15-billion dollars ($15,480,087,369), resulting in total tax revenues for the school district of $96,967,267. This is an increase of $16,776,760 in tax revenues over FY 2021-2022.

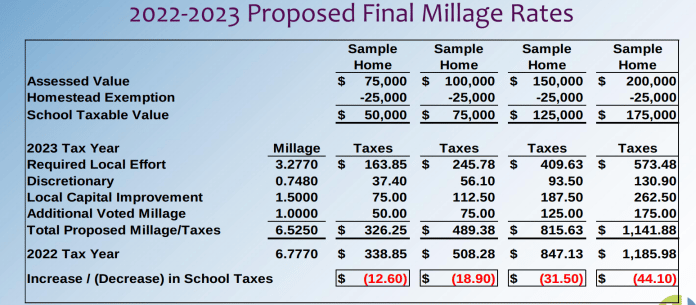

A school district analysis of homes of differing values show that collected school taxes will decrease in the 2022 tax year. The slide does not explain that the decrease in school taxes would only occur if the houses hadn’t increased in value at all. Being that there was a $3 billion increase in taxable values, this would not be the case for the average homeowner.

This illustrates the importance of establishing what the roll back rate is so the taxpayer can understand if their tax bill is likely to go up or down. The roll back rate is the millage rate where the same amount of tax revenues would be collected as the previous year.

Sittig presented all funds that make up the entire school district budget, which comprises six district funds. These funds are allocated according to standards established by the Governmental Accounting Standards Board.

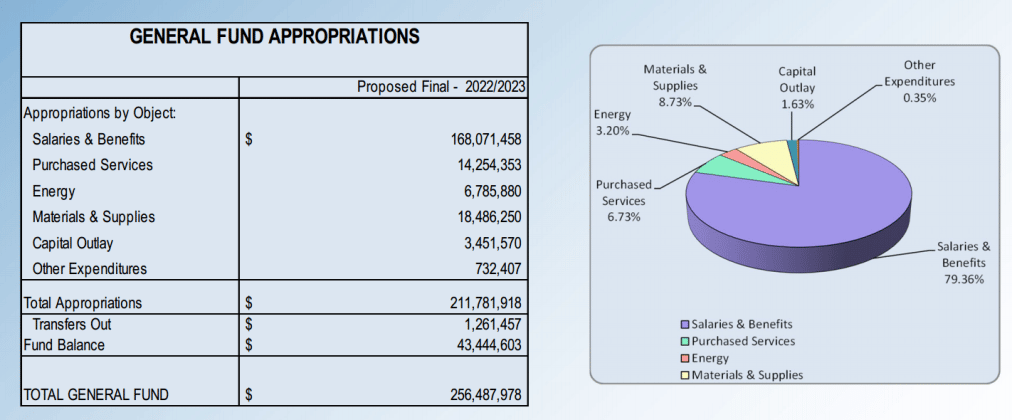

The general fund is the school district’s operating budget, derived from federal ($899,000) and state ($133,473,607) funds and local ad-valorem taxes (Property: $59,815,057 and Local $2,332,587). The recent 1 mill results in $14,860,884 for the General fund.

The federal revenue source comes from Hernando County’s Military ROTC (Reserve Officer Training Corps) and Medicaid reimbursements. The state revenue source is the previously mentioned FEFP calculation, and was received by the district in July. It also includes revenue from the Workforce Development program, state license taxes, and grants from the Southwest Florida Water Management District (SWFWMD).

The largest appropriation of the General fund is salaries and benefits, which total $168,071,458, or 79.36 percent of the fund. $1,261,457 is transferred to a new bus lease payment.

The district began the year with a beginning General fund balance of $42,802,188, and is expected to end the school year with a balance of $43,444,603. Ending balances also have non-spendable portions, and funds that are restricted or assigned to predetermined items. The unassigned portion coming into the 2022-23 school year is $17,872,967, or 9.12 percent.

Sittig credited support from the state and federal grants for the district beginning a new year in the black. “During 2021, the Florida Department of Education held districts harmless with respect to FTE (full time enrollment) losses. This would have resulted in a substantial decrease in our funding. Revenue from the CARES grant has allowed us to pay for expenditures that in any other year would have been paid using General Fund dollars. It is important that we continue preserving our fund balance so that we do not have a detrimental effect when regular operating resumes.”

Capital Outlay Funds are used for construction and acquisition of capital equipment and facilities. Notable expenses from this fund for 2022-23 are the Wilton Simpson Technical College ($8,444,787) and the Nature Coast Technical High School Criminal Justice Expansion ($200,000). Revenues for this fund come from ad-valorem taxes, proceeds from the one-half-cent sales tax, interest income and impact fees.

Food service is a self-sustaining fund with revenues generated from Federal reimbursement of student meals, Federally provided USDA (US Department of Agriculture) commodities, and State supplements in a limited amount required to match Federal grants, cash sales and payments from agencies to which food services are provided.

Salaries and benefits total $6,163,002 of the $23,581,131 budget. Materials and supplies are appropriated at $8,566,000. This fund has increased by $131,152. This will be the fifth year that Hernando District Schools will participate in the Community Eligibility Provision (CEP), which provides students with access to free school meals. Sittig reported that the budget for this program totals $17,020,000.

Federal entitlement grants, which include Title I, Title II, Title III, Title IV, Title VIII, Carl Perkins, and others including adult education total $16,754,903. Sittig said that when the DOE certifies the “roll forward” grant of an estimated $4,000,000, it will be amended into the budget.