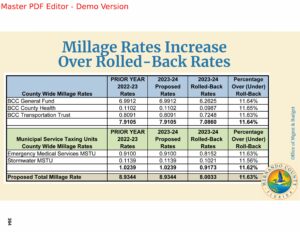

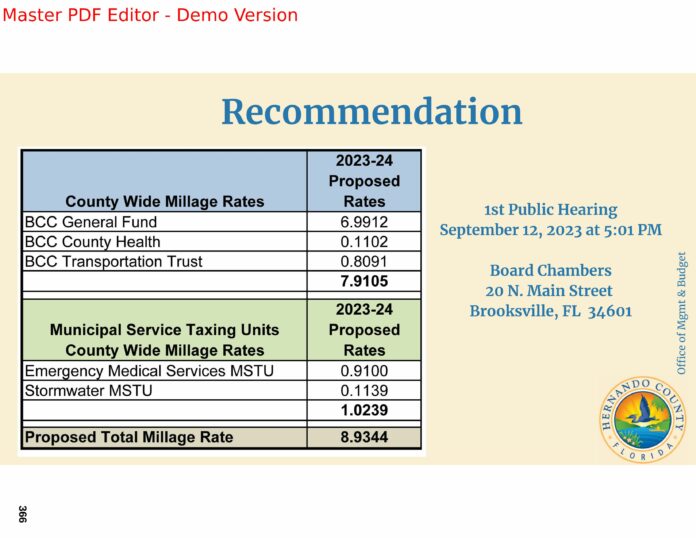

Commissioners voted 4-1 to set the current 8.9344 as the maximum total millage rate for fiscal year 2023-2024. The total millage rate is the rate the county uses to calculate Hernando County property tax. For reference, the rollback rate is 8.0033. The rollback rate refers to the rate that would produce revenue equal to the previous year’s rate. The 8.9344 figure represents the total millage rate for the county. The general fund millage rate would remain at 6.9912 if the maximum rates are approved at the final hearing in September. (The general fund millage rate is included in the total millage rate.) Commissioner Steve Champion was the opposing vote.

Champion pointed out, “This is an almost 12 percent increase in your (property) taxes… Even though the rate is supposed to stay the same, it’s 11.6 percent increase.” Champion would rather have the millage rate reduced, especially since home values have increased.

Chairman John Allocco cited the rate of inflation, which causes increased costs for practically everything. “Although our Federal Government is telling us the inflation rate has decreased, it’s not negative. It’s still just adding to the previous increases from previous years… Until we see some changes, we’re going to see the costs for everything stay high.”

Champion motioned to reduce the general fund maximum millage rate to 6.75 and have all departments cut their budget by 0.24 percent. The motion died due to a lack of a second.

Commissioner Jerry Campbell understood the points made by Champion and Allocco, and motioned to approve the proposed current millage rates. “Property values have increased, and to the Chairman’s point, our costs are through the roof. We do not know what the future holds. I think it’s time to double down on getting our infrastructure and our roads, economic development, all of these things moving forward… all of that takes money to do.” Commissioner Beth Narverud seconded the motion.

Commissioner Brian Hawkins clarified that Champion’s proposal would mean cutting approximately 3.5 million from the overall budget, which means cutting services as new residents move in. “Overall, the 11.6 percent (increase) — a lot of that is growth in the county, new people moving in.”

Hawkins added that going forward, when inflation stabilizes, he expects the percentages to come down.

The commissioners discussed the affordability of increased tax rates for property owners. Champion expressed concern that there are currently four homes with homestead exemptions that are listed in the Clerk of Court records as part of tax deed auctions. “That’s four homestead properties that will be sold at auction because they can’t pay the taxes … I haven’t seen homestead homes on there in years. This is hurting the people out there.”

According to Allocco, there are ”significant levels of discrepancy” in the plight of property owners. Allocco, a realtor, cited research showing that a large number of homes that sold for $550,000 to $600,000 in the past 1.5 years pay very little in property taxes. “You would be amazed at how many of them pay almost no taxes due to disability or other exemption.”

Commissioners discussed “flattening” such discrepancies between similar properties with such a large tax differential. Allocco summarized, “So we’re not having two houses that sit side by side; one pays $7,000 a year and the other pays $500 a year.”

Earlier this month, County Administrator Jeff Rogers presented the Fiscal Year (FY) 2023-2024 Recommended Budget of $690 million to the Board of County Commissioners (BOCC). The BOCC directed Hernando County staff to balance the budget by using the current tax rates with no increase in the General Fund millage for the 2023-2024 FY.

The presented budget focused on:

• Maintaining Reserves

• Economic Development

• Maintaining Fund for Storm Recovery ($1,461,516 current balance)

• Implementing minimum wage to $15

• Improving Service Efficiencies to meet increasing demands due to community growth

Featured Capital Improvements within the FY 2023-2024 budget include:

• Anderson Snow and Corporate Blvd. Intersection Improvements

• Animal Shelter renovation and expansion

• Multipurpose field

• Ernie Wever Master Plan

• Ridge Manor Water Reclamation Facility Expansion

• Airport Industrial Park Improvements

• Public Safety Training Complex

• Mermaid Lakes – Phase 1 Design

• Transit Transfer Facility

• County Line and Linden Signalization

• Septic to Sewer District A – Phase 1

The first public hearing for the FY 2023-2024 tentative millage and budget is scheduled Tuesday, September 12, 2023, beginning at 5:01pm. The adoption of the FY 2023-2024 final millage and budget is scheduled for September 26, 2023, beginning at 5:01pm. Both meetings will be in the John Law Ayers room located on the first floor of the Government Center at 20 North Main Street in Brooksville. You can also stream the meetings online by visiting www.HernandoCounty.us/WatchNow.

To view the FY 2023-2024 Recommended Budget Book, visit https://stories.opengov.com/hernandocountyfl/published/v2o4HNjR8.