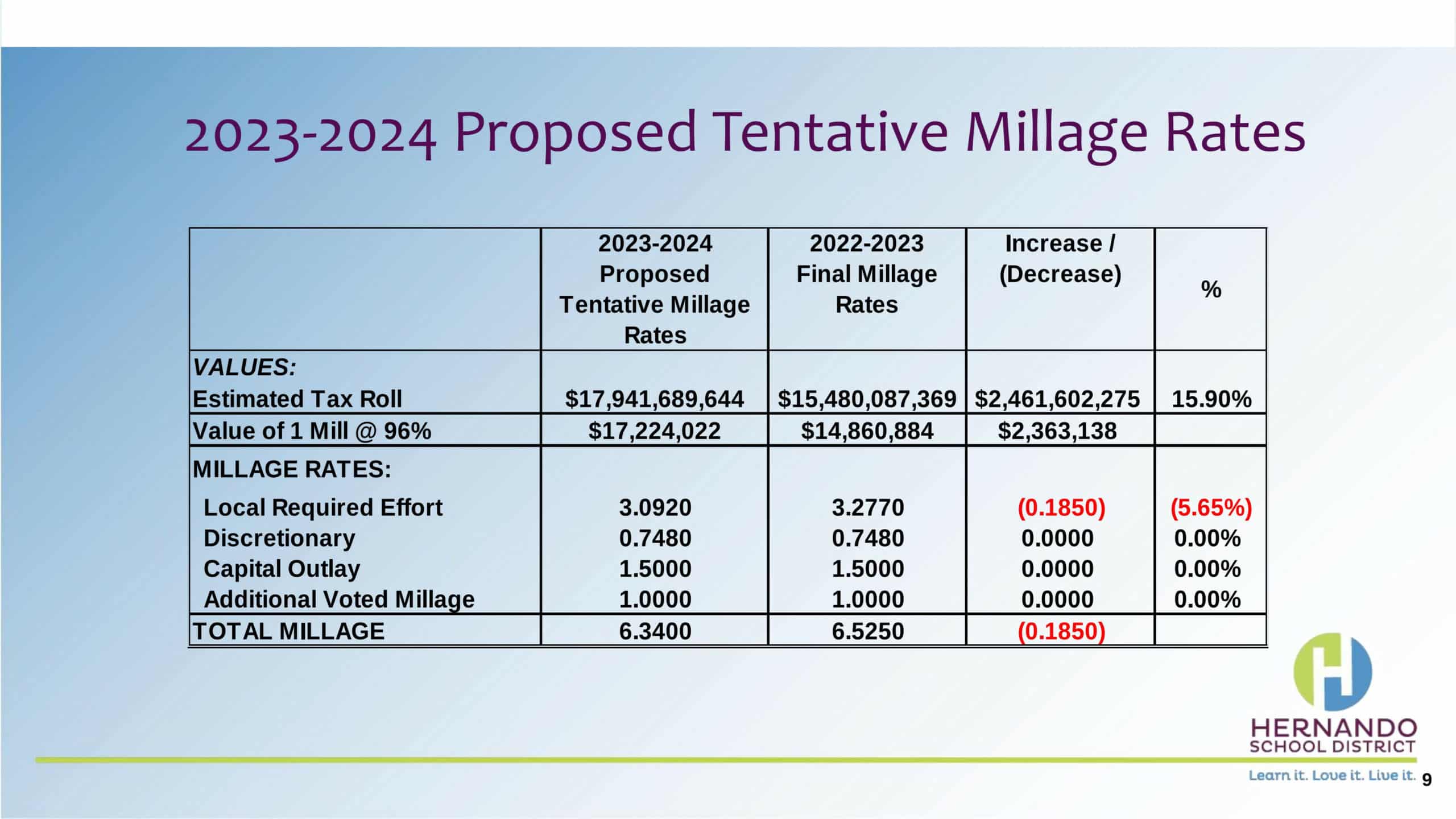

The Hernando County School Board held its first public budget hearing on July 25, 2023. The total tentative millage rate of 6.3400 was approved by the Board 4-1, with Shannon Rodriguez voting no. The proposed budget resolution was also approved 4-1, with Rodriguez opposing.

The tentative budget for fiscal year 2023–2024 is $505,947,817, an increase of $27,265,398 over the original budget for fiscal year 2022–2023. With transfers out, the total tentative budget comes to $491,417,494.

The second and final budget hearing will be held on September 5, 2023, at 5:01 p.m., at which time the board will make its final decision to adopt the budget and set the millage rate.

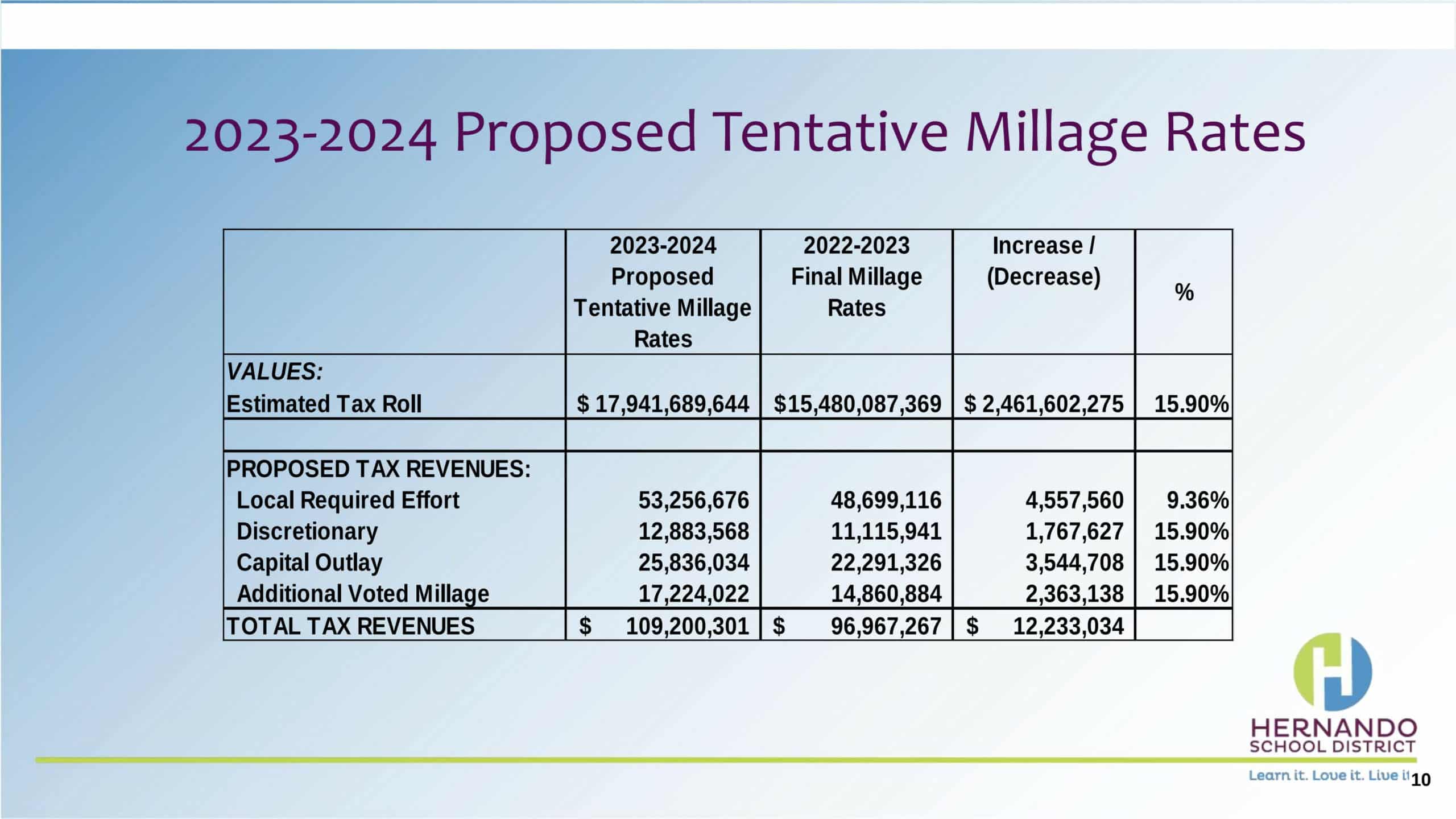

The total millage rate is a combination of millages for Required Local Effort (RLE), Discretionary, Capital Outlay, and the additional 1.0000 mills voters approved in 2020. The total tax revenue generated by the proposed millage rates is $109,200,301. This is a $12,233,034 increase over FY 2022-2023 tax revenues.

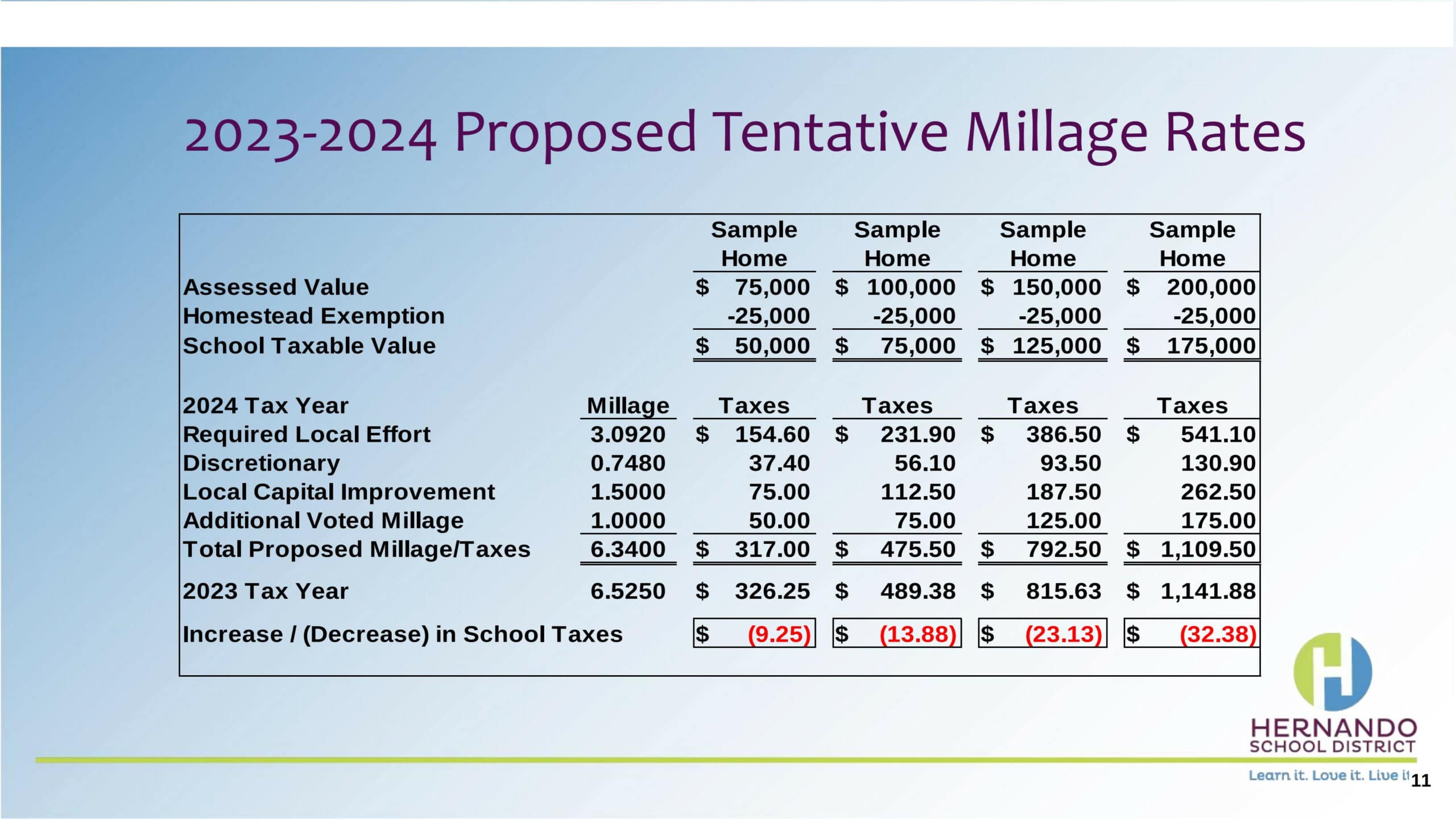

The Required Local Effort (RLE) millage is required by state law and is set by the state. The current proposed RLE rate of 3.0920 is higher than the rollback rate. The rollback rate refers to the rate that would produce revenue equal to the previous year’s rate. The rollback rate is the amount that would result in you roughly paying the same amount of tax as last year, discounting any new development. Last year’s RLE was 3.2770. In addition to the tax increase resulting from the RLE millage, the Discretionary, Capital Outlay, and 1 mill Additional Voted Millage will also contribute to the tax increase. (Each of these funds are basically higher than their rollback rates.)

Finance Director Joyce McIntyre explained the following pertaining to the RLE, “The board must levy the established RLE millage rate in order for us to receive the state share of FEFP (Florida Education Finance Program) funding, which is $115,051,110. We advertised notice of a tax increase because the ad valorem tax to be levied is greater than the amount raised last year, which makes the rollback rate positive. Even though the RLE millage has decreased, it’s considered a tax increase due to the substantial increase in the estimated tax roll.”

As advertised, total tax revenues are expected to increase by $12,233,034 over revenues for FY 2022-2023. Kendra Sittig, Budget Director, explained how the budget is calculated, and provided a long list of budget components, from teacher and administrator salaries to power and water bills.

The District’s proposed General fund revenues total $233,184,260, which includes $793,000 in federal dollars and $139,993,987 from the state. A carryover from last year’s budget of $48,047,057 brings the total proposed General Fund Revenue to $281,231,317.

Several other funds comprise the School District’s total budget. The Food Service Fund ($27,195,450), Special Revenue Fund ($19,493,161), CARE Grants Fund ($31,066,922), Debt Service ($19,246,540), and Capital Projects ($127,714,427). After subtracting “Transfers out,” the total tentative budget is 491,417,494. Transfers out of Capital Outlay are to be paid to Debt Service.

Sittig said, “While the increase in property tax revenue was substantial, the Department of Education reduced our funding for the Family Empowerment Scholarship by a total of $18.28 million.”

She further explained, “The state revenue represents an increase in the base student allocation from $4,587.40 to $5,139.73 per student. This constitutes an increase of $552.33 more than what we received in 22-23. The large increase in the base funding is the result of former categoricals such as reading, instructional materials, and teacher classroom supplies being rolled into the base. For 23-24, the District will no longer receive the Sparsity Supplement, which provides funding based on the number of fully enrolled students.”

In terms of the General Fund budget, 69 cents of every dollar is allocated to instruction, which primarily covers salary and benefits for teachers as well as supply costs. This also includes learning support provided by counselors, librarians, nurses, and others.

School administrators, maintenance and custodial services, and the transportation department receive 26 cents. Five cents are allocated to District Support.

Public and Board Member Comments

Transparency was the main concern among the citizens who appeared at the meeting. The increase in property taxes was another. Transparency is called into question because the presented categories did not include specific expenditures.

Diane Liptak said of the millage rate, “You are collecting an additional $2.5 million just by the value recorded by the assessed rates. If you’re getting an additional $2.5 million, why in heaven’s name do we need an additional millage to be added on?”

Regarding line items within the School Board’s tentative budget, she said, “What I’m seeing is apparently, we do not do a cleanup year to year of the contract. We don’t go through line item by line item and say, ‘This is long since out of date; what are we doing with it?”

Liptak did not specify which items in the budget are no longer necessary.

Brad Benson addressed the Board with a low opinion of the budget. “As it happens, I was in government far too long, and have experience with budgets. This is not a budget. This is garbage. I’ve been through every page, you cannot have revenue and outlay on the same page. Revenue is income, outlay is expenditures. You cannot have them on the same title page.”

Jack Martin, a former pastor who homeschooled six children, stated he has no issue with paying school taxes but is concerned that tax increases are burdening property owners.

Monty Floyd, who ran for the District 5 School Board seat in the 2022 election, read from a prepared statement, echoing Liptak and Benson’s request to see discrete line item entries in the school board budget rather than a categorical overview.

During the vote to approve the budget proposal, Board Member Mark Johnson said, “The line-numbered items are available by Freedom of Information… Once we adopt this, those numbers are available for inspection. They are not here in this presentation, but the underlying numbers are available.”

Johnson added, “We do review, I’ve been reviewing the programs. I know Ms. Rodriguez has been reviewing the programs to see where waste is and get rid of them… as they come up for renewal.”

Adjusting the millage rate to avoid a tax hike, as suggested by Rodriguez, would result in an $8 million shortfall for the District (as the budget sits currently), according to Finance Director Joyce McIntyre.

Johnson asked for clarification on when the itemized budget would be available for inspection. Budget staff said it will be available for inspection after the final budget is approved in September.

Johnson asked if a tentative itemized budget could be available for inspection. McIntyre stated that they are in the middle of an audit for 22-23 and are still making audit adjustments. “It’s rolling, so I don’t know that it would be,” she said.

However, Superintendent John Stratton invited anyone to inspect the budget records further. “We will happily, happily share line items, and we have in years previous as well. In fact, we’ve got some pretty extensive reports that the public is welcome to. We welcome you to come in and sit down. If you want, they’ll show you exactly what we’re spending money on.”