In a previous issue, the Sun reported on the first of two budget hearings held by the Hernando County Board of County Commissioners (BOCC) on September 12. On Tuesday, September 26, 2023, the second of the two hearings took place over a nearly two-hour span to finalize the budget. With a 4 to 1 vote, the BOCC approved the Fiscal Year 2024 final budget totaling $767,373,154.

Before settling on the current General Fund millage rate of 6.6997 at the previous budget hearing, the millage rate was initially proposed to be set at 6.9912, but the rate was ultimately lowered to 6.6997 after an extended discussion. This reduction of 0.2915 mils was officially ratified at Tuesday’s hearing. Funds were diverted from the reserves to lower the millage rate slightly, as had been discussed during the first budget hearing. The result is the millage having been lowered for a fourth straight year with a total reduction of 1.0915 over that span.

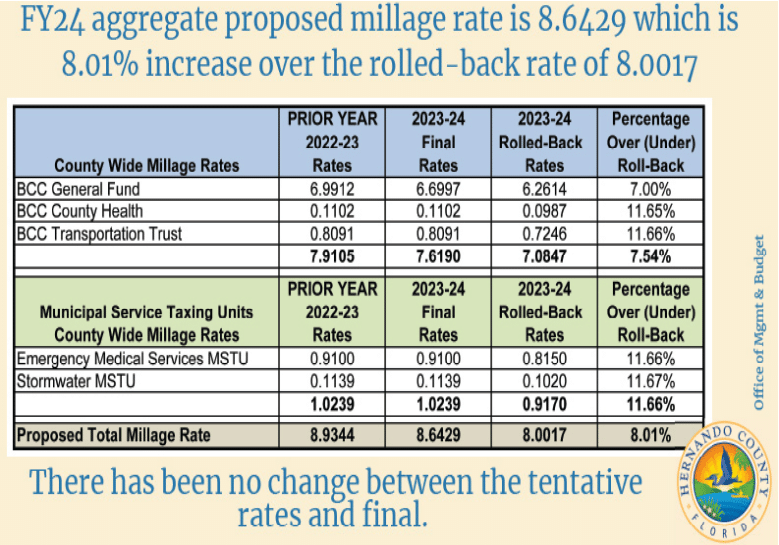

Several funds make up the total millage, including the General Fund millage. The total millage rate for FY 2024 is 8.6429. This is about 8 percent over the rollback rate (8.0017), where projected tax revenues for FY 2024 would equal the previous fiscal year’s tax revenues. The millage rate may have been lowered, but tax revenues have increased yearly due to increasing property values.

“The overwhelming intent of this board was to sharpen the pencil over these last two weeks and to come back with a proposal to cut this budget – to cut actual expenditures from the budget,” said Commissioner Jerry Campbell. The dissenting vote in the decision, Campbell was diametrically opposed to tapping into the reserves to lower the millage. Chairman John Allocco also voiced his apprehension regarding reserve usage. Allocco ultimately voted for the resolution to pass, but he stated, “I am not going to vote for it again if it is coming out of reserves.”

The dollar amount that Hernando County Budget Director Toni Brady confirmed the board had planned to take from the reserves at the start of the council meeting was roughly $4.3 million. This brought the reserves down from 25 to 23 percent, as they had previously discussed. The county also has a small additional amount of funding for economic development that brings the percentage to a total of 24.04.

Throughout the hearing, citizens had various opportunities to come before the board to air their grievances. One such complaint came from Diane Liptak from Hernando Beach, Florida. Liptak felt that taxes should be reduced further and complimented Commissioner Steve Champion’s efforts in helping to decrease the proposed budget. The Hernando Beach resident did take issue with the county’s “wish list” projects, such as the recreational development of the preserves.

“Maybe wish lists should be reduced… I’m saying the development of the preserves is a wish list,” said Liptak. “This is not something that is going to impact anybody’s life drastically over the next couple of years. That’s money that if spent on the people, taken out of their taxes, taken out of their insurance, they’re going to be able to eat.”

She followed up that she understood that funds allocated to some of these items are fixed by the state, but she urged that there must be “a way that we can get the state to cut those mandates.” Though the board was able to reduce millage rates yet again, it appeared clear that few were happy with the result and more begrudgingly accepting of the resolution.

A more detailed enumeration of the budget is listed below:

The Fund Description:

General Fund – 6.6997

Transportation Trust Fund – 0.1102

Health Unit Trust Fund – 0.8091

Emergency Medical Services Municipal Service Taxing Unit (MSTU) – 0.9100

Stormwater Management MSTU – 0.1139

Fiscal Year 2024 Approved Budget by Fund Type:

Enterprise – $276,539,588

Special Revenue – $206,646,086

General Fund – $202,249,885

Internal Service – $56,020,526

Capital – $21,096,320

Debt Service – $4,820,779

Fiscal Year 2024 Approved Budget by Revenue Source:

Other Sources – $375,215,296

Taxes – $134,400,186

Charges for Services – $113,826, 412

Licenses and Permits – $59,952,165

Intergovernmental – $47,849,412

Transfers – $28,790,030

Miscellaneous – $6,927,324

Fines and Forfeitures – $412,329