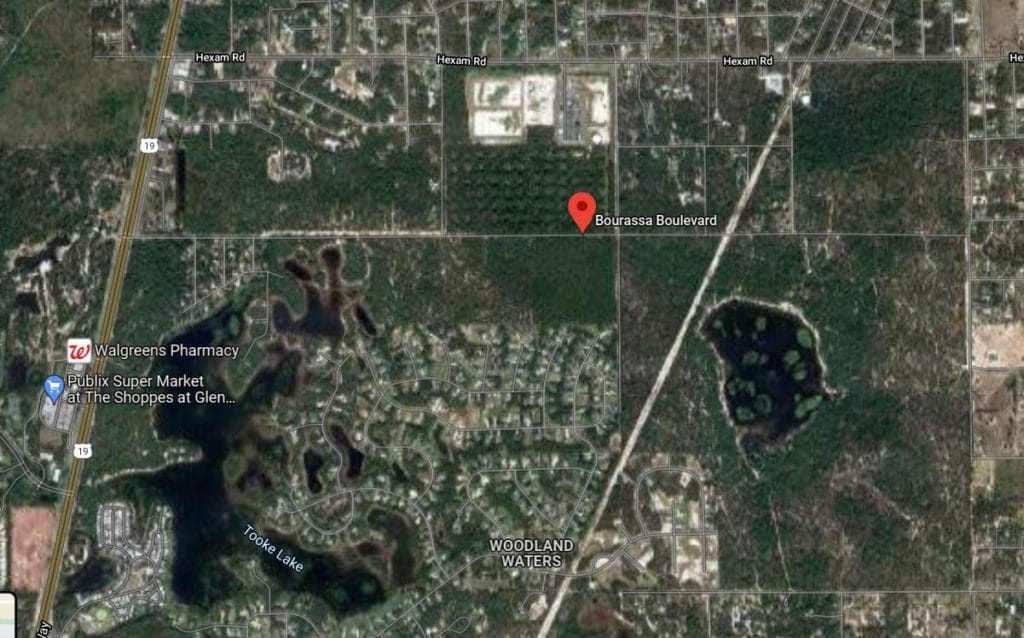

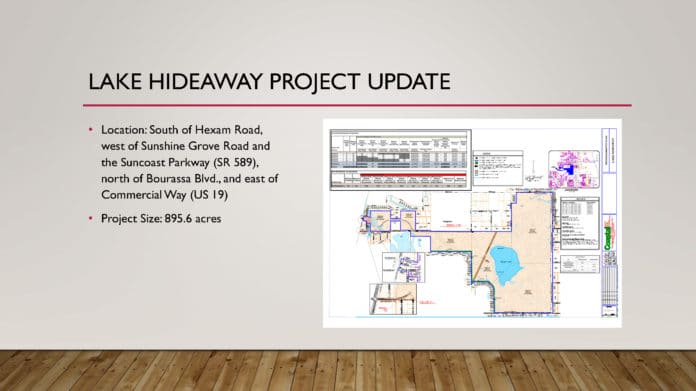

The Board of County Commissioners (BOCC) voted unanimously to approve establishing the Lake Hideaway Community Development District (CDD) on OCt. 26, 2021. The 229.43-acre development, located near Woodland Waters is the first of a 3-phase plan, which has been approved for 2,400 single-family homesites, 1,300 multi-family units, 50,000 square feet of commercial retail space, and 150,000 square feet of office space. The next two phases will be addressed in the future.

Michael Lawson, Director of Operations of Metro Development Group reported that home sales are expected to begin in 2023 and the development populated by 2035, with roughly 300 closings per year. The petitioner on the record is Hawk Land Investors New, LLC of Delaware.

Dana Collier with the attorney group Straley, Robin, and Vericker introduced the finer points of the CDD.

A CDD is a local unit of special-purpose government established under Florida law to finance and manage the infrastructure required to support the development of a community. It allows the developer to obtain low-cost financing by issuing tax-exempt bonds. The bonds are paid via special assessment in the form of a non-ad-valorem property tax.

There is no financial obligation to the county.

A CDD’s main powers are to plan, finance, construct, operate and maintain community-wide infrastructure and services specifically for the benefit of its residents. In the case of Lake Hideaway, this will include recreational facilities, stormwater management, landscape and hardscape, and street lighting through an agreement with the power company that services the area.

The CDD will also establish parks, provide security and enact community rules.

CDDs complement the responsibilities of Homeowners’ Associations (HOAs). Many of the functions handled by HOAs in one community may be handled by the CDD in another.

County Attorney Jon Jouben addressed a recent complication that arose in Southern Hills, which has both a CDD and an HOA. Through a legal process called escheatment, the county ended up responsible for selling foreclosed homes in Southern Hills, however, was not responsible for the taxes owed. It still resulted in difficulty in selling the properties due to the “perceived cloud on the titles.”

Commissioner John Allocco requested of Lawson and Collier that language be added to the CDD documentation explicitly stating that the county has no responsibility for property taxes in the event of a default.

A CDD is governed by a Board of Supervisors which is elected initially by property owners, then begins transitioning to residents of the CDD after six years of operation. In common with other municipal, county, state, and national elections, the Office of the Supervisor of Elections oversees the vote, and CDD Supervisors are subject to state ethics and financial disclosure laws. The CDD’s business is conducted in the “Sunshine,” which means all meetings and records are open to the public. Public hearings are held on CDD assessments. The CDD’s budget is subject to an annual independent audit.

According to the exhibits included with the ordinance, the initial Board of Supervisors is Michael Lawson, Doug Draper, Lori Price, Sonia Valentin, and Christie Ray. All of the initial board members are from the Metro Development Group, LLC, 2502 N. Rocky Point Drive

Suite 1050, Tampa, FL 33607.

It is not uncommon for the initial Board of Supervisors to be colleagues or even families of land developers, which are usually the owners of record. One of the criticisms of CDDs is that until residents own property greater than 33% of total votes, they may not have a single representative on the board. Only when the residents own property greater than 50% of total votes will they have an opportunity to outvote the supervisors chosen by the developer.