Happy New Year, Neighbors. Wow, 2021 and 2022 took us on a crazy real estate market ride that was anything but normal. We went from a buyer frenzy due to a lack of inventory combined with historically low-interest rates to higher-than-usual home price appreciation and rent increases. All coming to what felt like an overnight slowdown when the federal reserve, in an effort to curb inflation, began to increase interest rates to a 20-year high, making housing affordability either a stretch or out of reach for a large percentage of buyers.

Good news, hopeful signs have begun to appear for the housing market leading into 2023. The recent mortgage interest rate declines over the last six weeks have lowered the monthly mortgage payments, making a median-priced home 10% more affordable.

Additionally, predictions are that if inflation stays in check, we could see mortgage interest rates move closer to 6 percent early in the new year, which in turn will help to bring more buyers back into the market.

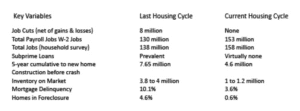

Other key variables, comparing the last housing cycle (crash of the market) to our current housing cycle (lack of inventory), support a healthier housing market making it extremely unlikely we will see a housing market crash anytime soon. Currently, we only have a 2.6-month supply of housing inventory. Please see the list to the right on comparisons of the key variables.

I hope you have found value in this information and that if you are looking to sell or purchase real estate, these statics have given you some insight and hope, together with affirming that owning real estate is still one of the greatest ways to build wealth and stability. I encourage you to reach out to your local REALTOR® if you have questions regarding the information provided, and don’t hesitate to begin the conversation on how we can help you accomplish your real estate goals. Your local REALTOR® can be an amazing resource for you.