JULY 30, 2019- It was a close and contentious vote, but the Board of County Commissioners (BOCC) voted 3-2 to increase the proposed millage rate advertised on the TRIM by 1 mill, which equates to a 14.51% increase in taxes, that promises to fix the county’s deficit, which now stands at around $8,000,000.

Commissioners Steve Champion and Wayne Dukes voted against the increase.

As per Florida Statutes (Chapter 200) Determination of Millage which governs TRIM Compliance, the Board (Taxing Authority) is required to advise the Property Appraiser by Friday August 2, 2019, of the proposed maximum millage rates and the date, time and place of the First Public Hearing so that they can be noticed on the TRIM notice. By setting the maximum millage the Board can lower the millage rates but may not raise them.

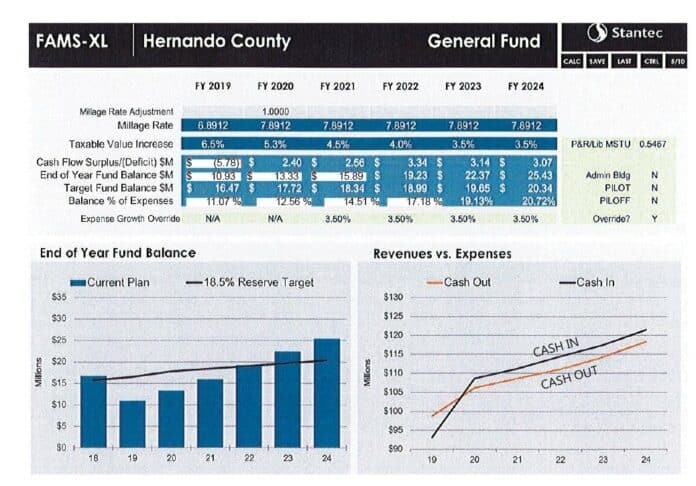

Budget Director Stephanie Russ presented to the board at the July 30, 2019 Board of County Commissioners meeting. The proposed general fund millage rate for FY 2019-2020 is 7.8912, which is 1 mill higher than the current 6.8912.

Commissioner John Allocco asked what the budget would look like without the millage increase. Russ had on hand representative slides from the recent Stantec presentation, and she displayed one with an unchanged millage rate through FY 2024, showing a complete depletion of reserves in 2021, and an ever-widening gap between revenues and expenses, with expenses “winning.”

In this scenario, the board is looking at cutting services such as parks and libraries. According to Rogers, the largest department is Facilities, however is deemed too important to consider service cuts.

The chart that accompanied the introductory letter in the interim budget proposal considers a 1 mill general fund increase, and also the discontinuation of accounting for the proposed Admin Building. In this scenario, the reserve fund hits its 18.5% target in FY 2021, and revenues surpass expenses as early as FY 2020.

Champion, adamantly opposed to any tax increases said, “The elephant in the room … is $7.5 million more than last year for (HCSO).” Champion asserts the remedy is for all constitutional offices “hold the line” with zero extra funding, and zero reduction in staff.

Considering a faster fix, “Holding the line and cutting $4 million would fix the issue,” Champion said. Allocco disagreed, maintaining that he could not see a way HCSO could cut $4 million without cutting services or decreasing service levels.

Dukes agreed with Champion’s proposal.

Commissioner John Mitten calls the increase a “Public Safety” increase, asserting that the increases are a result of increased costs of insurance and other necessary equipment.