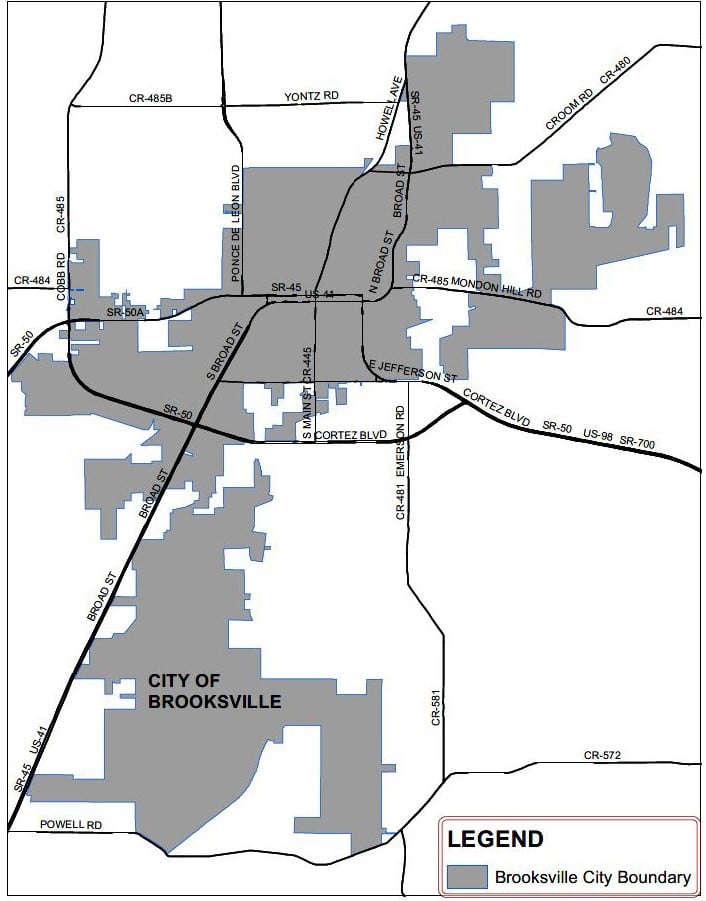

The City of Brooksville, Florida (the “City”) imposes non-ad valorem special assessments each year to fund the provision of fire protection services and facilities. The City Council is now in the process of adopting assessment rates for the City’s fiscal year which begins October 1, 2020 (“Fiscal Year 2020-21”). Notice is hereby given that the City Council will conduct a public hearing to consider adoption of an Annual Assessment Resolution to approve the fire assessment rates for Fiscal Year 2020-21 and collection of the assessments by the Hernando County Tax Collector pursuant to the tax bill collection method for such fiscal year and each fiscal year thereafter. The assessment is an annual assessment that will continue from year to year.

The public hearing will be held on September 3, 2020 at 3:30 p.m., or as soon thereafter as the matter may be heard, for the purpose of receiving public comment on the proposed fire assessment rates for Fiscal Year 2020-21. Due to the COVID-19 public health emergency, and in accordance with the authority granted by Executive Order 2020-069 issued by Governor Ron DeSantis, as amended by Executive Order 2020-179 and as may be further amended, this hearing will be conducted virtually via communications technology using the Zoom platform. Persons wishing to participate and access the public hearing through Zoom must register via the link provided on the City’s website or may contact the City Clerk at 352-540-3816 or send an email to [email protected], to receive a link for access to the virtual public hearing. The Zoom platform will allow you to attend and participate in the public hearing through an internet connection or by telephone. Once an attendee is in the virtual public hearing, the Mayor or the City Clerk will inform you of how to participate at the designated time. If you experience difficulty using Zoom during the virtual public hearing you can call the City Clerk at 352-540-3816 for technology guidance.

The public hearing will also be available for viewing only by live stream during the public hearing. To view the public hearing on HCGB Channel 644, go to https://hernandocountyfl.iqm2.com/. A recording of the public hearing will be available on that website for viewing the next day, or as soon thereafter as possible.

The public is advised to check the City website for up-to-date information on any changes to the manner in which the public hearing will be held and the location.

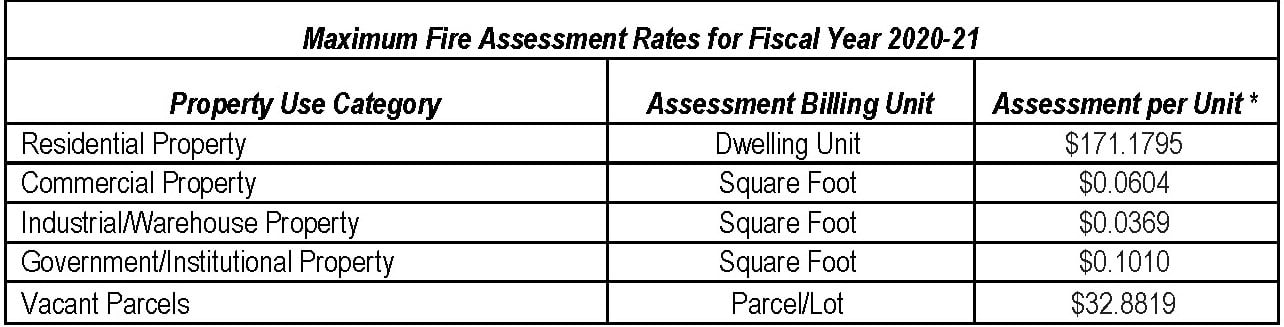

The fire assessment for each property is determined according to property use categories and historic fire incident reports and call data for each category (the “Demand Methodology”), with the annual fire imposed against residential property on a per dwelling unit basis (or per mobile home space in the case of mobile home parks), against vacant property on a per lot basis, and against all other property based on the square footage of buildings located on the property. At the September 3 public hearing, the City Council will consider the fire assessment rates for Fiscal Year 2020-21 which will not exceed the following:

*Assessment rates in the table above have been rounded to four decimal points. Individual assessment bills will be rounded to two decimal points, or the nearest cent.

A more specific description of the fire assessments proposed for Fiscal Year 2019-20 and the Demand Methodology are set forth in Resolution Nos. 2019-06 and 2019-17 (the “Fire Assessment Resolutions”). Copies of the City’s Fire Assessment Ordinance (Ordinance No. 830), the Fire Assessment Resolutions and the proposed Fire Protection Assessment Roll for Fiscal Year 2020-21 are available for inspection at City Hall located at 201 Howell Avenue, Brooksville, Florida 34601 or by contacting the City Clerk by email at [email protected].

The fire assessments will be collected on the ad valorem tax bill to be mailed by the Hernando County Tax Collector in November 2020, and each November thereafter, as authorized by section 197.3632, Florida Statutes. Florida law provides that failure to pay the assessments will cause a tax certificate to be issued against the property which may result in a loss of title. If you have any questions regarding the amount you are assessed, please contact Fire Chief Ron Snowberger at (352) 540-3842.

All affected property owners have a right to attend and participate in the public hearing as described above and to file written objections with the City Council prior to the public hearing. Comments may be submitted by email to [email protected] to be received no later than 30 minutes before the start of the public hearing or by U.S. mail to Jennifer Battista, City Clerk, 201 Howell Avenue, Brooksville, Florida 34601. If timely received by email or U.S. mail, the public comment will be read during the public hearing, not to exceed 3 minutes in length. When providing public comments or input by mail or email, please include your name and address for the record.

As required by Section 286.0105 Florida Statutes, if a person decides to appeal any decision made by the Brooksville City Council with respect to any matter considered at the meeting or hearing, he or she will need a record of the proceedings, and that, for such purpose, he or she may need to ensure that a verbatim record of the proceedings is made, which record includes the testimony and evidence upon which the appeal is to be based. Persons planning to attend or participate in the public hearing or meeting who need special assistance to access the public hearing or meeting must notify the City Clerk at 352-540-3816 or send an email to [email protected] no later than 24 hours preceding the public hearing or meeting.

(08/14/2020)